1. Introduction

The financial landscape in the European Union (EU) is undergoing a profound transformation driven by fintech innovations and digital advancements. From the rise of neobanks to the integration of artificial intelligence (AI) in financial services, digital finance is reshaping how consumers and businesses interact with banking and investment platforms.

This article explores four big bets shaping the future of EU banking: the evolution of neobanks, the regulatory and innovation implications of MiCA, the development of Central Bank Digital Currencies (CBDCs), and the growing impact of AI and automation. Each section highlights not only where we are but where we’re headed — and what financial institutions must do today to stay ahead of the curve.

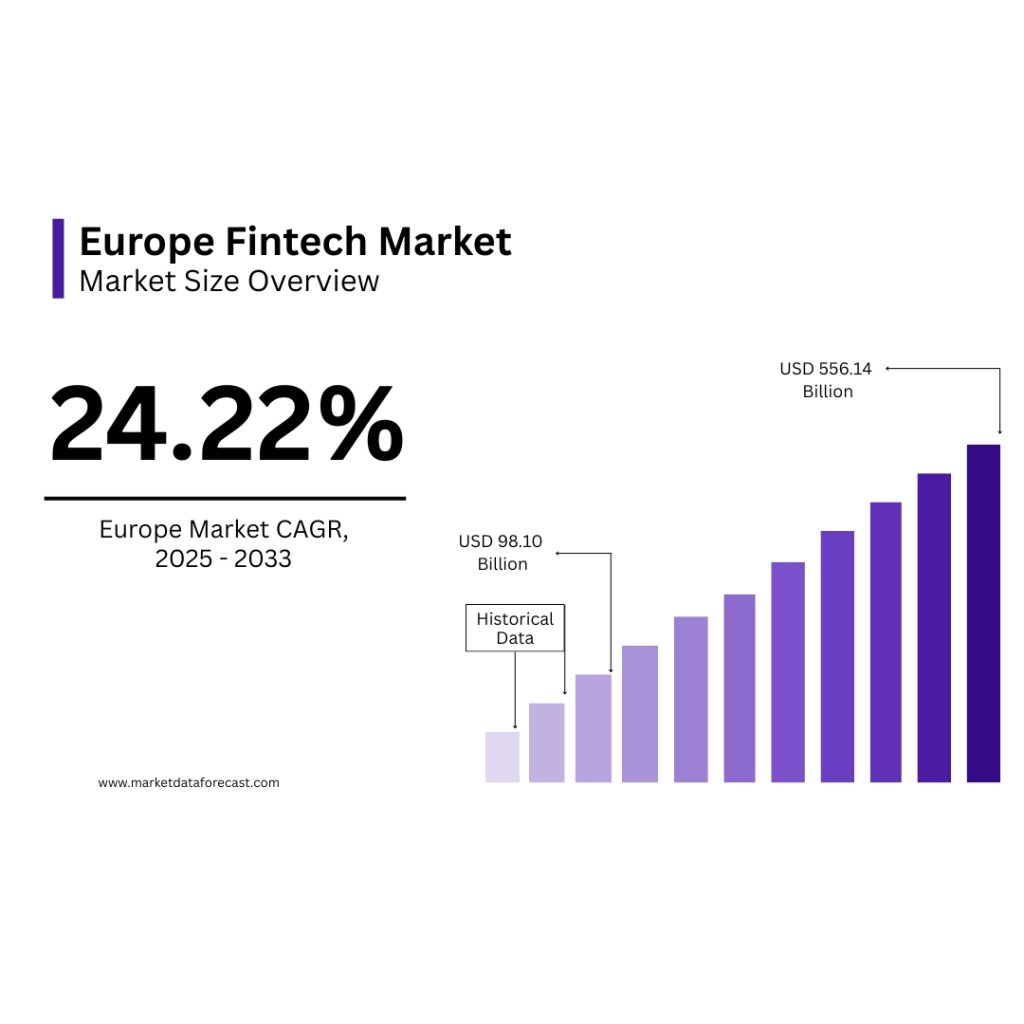

Source: Europe’s Fintech Market Size https://www.marketdataforecast.com/market-reports/europe-fintech-market

2. Neobanks: Evolution, Consolidation, and Competition

- Regulatory Support: The EU’s Revised Payment Services Directive (PSD2) enables open banking, allowing neobanks to access customer data and offer personalised services.

- Cost Efficiency: Operating without physical infrastructure allows for reduced overhead and competitive pricing.

- Enhanced User Experience: Instant payments, AI-driven insights, and international transfers offer a seamless digital experience.

Case Study: Revolut — From a foreign exchange app to a full-service neobank, Revolut exemplifies successful digital-first growth, offering multi-currency accounts, crypto trading, and business banking. However, the next chapter may be more complex. As interest rates rise, questions loom around the long-term profitability of neobank models, many of which rely on interchange fees and venture funding. The market is seeing early signs of consolidation, and some predict M&A activity will increase among digital banks.

Neobanks also face new competitive threats:

- Big Tech encroachment (e.g., Apple Pay Later, Google Wallet integrations)

- Digitising incumbents launching hybrid models with both digital ease and human service

- Bank-as-a-Service (BaaS) providers enabling non-banks to offer financial services seamlessly

As the lines blur between technology providers, retailers, and traditional banks, neobanks risk being squeezed from both sides — by tech giants with deep user ecosystems, and by incumbents with capital and compliance experience.

Strategic Play: Neobanks must move toward sustainable monetisation — targeting SME services, embedded financial tools, or partnerships with fintech ecosystems.

3. Blockchain and Crypto Regulation: From Compliance to Innovation

The EU crypto market has surged, boosted by regulatory clarity and institutional entry. The Markets in Crypto-Assets Regulation (MiCA), adopted in June 2023, represents a phased rollout:

- Mid-2024: Stablecoin regulation enforcement

- End-2024: Crypto Asset Service Provider (CASP) compliance deadline

MiCA’s Objectives Include:

- Licensing & supervision of CASPs

- Consumer protection mandates

- Stablecoin reserve requirements

- Market integrity standards

Example: Binance France received AMF approval; Kraken enhanced its EU customer protection features.

Note: ESMA estimates DeFi protocols make up 4% of global crypto-assets. This should be interpreted cautiously given decentralised reporting limitations.

But MiCA is not only about compliance — it could also catalyse innovation:

What’s Next:

- Tokenisation of real-world assets (the new RWAs): Beyond crypto-native assets, financial institutions are beginning to explore tokenising traditional assets such as real estate, government bonds, private equity, and investment funds. These tokenised versions could be issued on permissioned or public blockchains, enabling fractional ownership, real-time settlement, and greater accessibility. This shift could democratise investment products and significantly lower operational costs across capital markets.

“The tokenization of global illiquid assets is projected to be a $16 trillion business opportunity by 2030, driven by efficiency, fractional ownership, and access to new investor segments.” — Boston Consulting Group & ADDX, Revolutionizing Real-World Asset Tokenization (2022)

- Interoperability standards: As digital asset adoption scales, seamless interaction between different blockchain networks (public, private, and consortium-led) will be essential. The EU is expected to see increased focus on interoperability protocols, enabling cross-chain transfers, multi-asset settlement, and integration with traditional finance systems. Industry initiatives, such as ISO 20022 alignment and pan-European digital identity frameworks, are also laying the groundwork for secure, interoperable digital asset ecosystems.

“Interoperability is foundational for the integration of blockchain-based finance with existing financial market infrastructure, requiring both technical protocols and regulatory coordination.” — World Economic Forum, Interoperability in Digital Asset Ecosystems (2023)

Strategic Play:

- Invest in compliant crypto infrastructure

- Explore tokenisation-as-a-service models

- Partner with blockchain firms specialising in RWAs

4. CBDCs & the Digital Euro: Preparing for a Post-Cash Economy

The European Central Bank (ECB) is advancing the development of a Digital Euro[^1]. While initial pilots are focused on wholesale and limited retail use, the implications are massive.

Why It Matters:

- Provides a public digital alternative to private stablecoins

- Supports financial inclusion and innovation

- Offers faster, cheaper cross-border payments

Emerging Considerations:

- Programmable Money: Trigger-based payments and conditional spending

- Disintermediation Risk: If citizens can hold central bank money directly, what happens to deposits held by commercial banks?

- Privacy Concerns: Striking the right balance between anonymity and AML obligations

Future State (2027?): A maturing CBDC ecosystem could include:

- CBDC-linked savings and lending products: Banks may offer interest-bearing digital euro accounts or micro-loan services tied directly to programmable CBDC contracts, enabling automated repayments and dynamic interest rates.

- Wallet integrations by private banks: Expect a surge in value-added services like real-time FX conversions, personalised cashback schemes, and loyalty reward programmes — layered on top of CBDC infrastructure to retain customer engagement.

- Smart contracts enabling programmable financial services: These could support automated invoicing, tax withholding, subscription billing, or conditional loan disbursement, offering efficiency gains for both retail and corporate users.

- New roles for banks as intermediaries: Even with direct access to central bank money, commercial banks could position themselves as innovation hubs, offering CBDC compliance-as-a-service[^2].

- Cross-border interoperability pilots: With global coordination on digital currency protocols underway, we may see pan-EU or even EU–APAC CBDC corridors enabling low-cost international settlements by 2027[^3].

Strategic Play:

- Build CBDC-compatible digital wallets

- Engage in ECB pilot programs

- Rethink product offerings to stay relevant in a direct-to-consumer central bank money environment

5. AI & Automation: The Next Wave of Financial Intelligence

Artificial intelligence is no longer just a back-office tool — it is rapidly evolving into a core driver of strategic transformation in finance. From hyper-personalisation to risk intelligence, and from real-time compliance to algorithmic investment, the next generation of AI solutions is poised to redefine how financial institutions operate and compete. Here’s a look at what’s coming next:

- Autonomous Finance: These are self-driving financial systems that automatically optimise spending, savings, and investments based on real-time user data and behavioural insights. As GenAI and APIs mature, we may soon see smart financial agents that move funds, switch utility providers, or refinance loans with minimal user intervention.

- GenAI in Investment Strategy: Large Language Models (LLMs) are now being trained on financial datasets to deliver real-time market commentary, generate custom investment theses, and run sentiment-driven allocation models. Vanguard and BlackRock have both announced internal pilots for GenAI-based research assistants to augment portfolio managers.

- Self-Adaptive Compliance: As regulations evolve, AI-driven compliance engines can continuously update risk models, flag anomalies, and auto-adjust workflows. This is especially vital for ESG and AML tracking in cross-border operations.

- JPMorgan’s COiN automates legal contract reviews, processing over 12,000 commercial loan contracts in seconds

- HSBC employs AI across fraud detection, trade finance, and internal audit optimisation

What’s Coming:

- EU AI Act: The forthcoming regulation classifies financial services AI (e.g., credit scoring, robo-advisors) as high-risk, requiring detailed documentation, explainability protocols, and real-time audit logs

- AI Explainability & Ethics: Institutions will be required to prove that their AI models do not discriminate or hallucinate, especially in customer-facing applications

Risks to Monitor:

- Hallucinations in GenAI responses: Large Language Models, while impressive, are known to generate fabricated or misleading outputs when data is incomplete or ambiguous. In high-stakes financial environments, such hallucinations can lead to flawed investment advice or incorrect client disclosures. Institutions must implement robust human-in-the-loop review mechanisms and confidence scoring systems.

- Bias baked into training data: AI models trained on historical financial data can reinforce discriminatory practices, such as unequal credit scoring or investment bias. The European Commission and EBA are increasingly focused on AI fairness, and upcoming EU regulations will require institutions to conduct regular audits for bias and discrimination.

- Regulatory scrutiny from ESMA, EBA, ECB, and national regulators: As financial institutions scale AI use in compliance, client onboarding, and advisory functions, they face heightened scrutiny. Regulators are demanding transparency into model logic, real-time monitoring, and full explainability for decisions made by AI — especially in contexts impacting financial access or risk scoring.

Strategic Play:

- Invest in explainable and auditable AI

- Establish cross-functional AI governance bodies

- Deploy GenAI cautiously in investment and advisory functions

6. Conclusion: Betting on the Future, Today

The fintech revolution in the EU is not a distant horizon — it’s an unfolding reality. Regulatory shifts like MiCA and the AI Act, structural changes from CBDCs, and the competitive evolution of neobanks will reshape the industry by 2027.

“Financial firms that fail to digitise now risk becoming obsolete in five years.”

To stay competitive, financial institutions must act today — by investing in infrastructure, building strategic partnerships, and embracing innovation.

Next Step: Explore the Future With Us

At Aspect Advisory, we help financial institutions and fintech firms navigate this evolving landscape. From market entry to regulatory compliance and AI integration — our team delivers actionable strategies and hands-on support.

Get in touch directly to start your digital finance transformation.

Sources:

- ECB Digital Euro – Scope and Design: https://www.ecb.europa.eu/paym/digital_euro/html/index.en.html (Referenced in CBDCs section)

- BIS Project Rosalind – CBDC Private Sector Innovation: https://www.bis.org/about/bisih/topics/cbdc/rosalind.htm (Referenced in CBDCs section)

- IMF – CBDC and Cross-Border Settlements: https://www.imf.org/en/Publications/fintech-notes/Issues/2024/05/15/Cross-Border-Payments-with-Retail-Central-Bank-Digital-Currencies-547195 (Referenced in CBDCs section)

- PSD2 and open banking: https://cpl.thalesgroup.com/blog/access-management/open-banking-psd2-open-api (Referenced in Neobanks section)

- Neobank overview: https://stripe.com/resources/more/neobanks-101 (Referenced in Neobanks section)

- Finextra on neobank innovation: https://www.finextra.com/blogposting/27770/neo-banks-revolutionizing-the-future-of-digital-banking (Referenced in Neobanks section)

- McKinsey Fintech growth: https://www.mckinsey.com/industries/financial-services/our-insights/fintechs-a-new-paradigm-of-growth (Referenced in Introduction and Neobanks sections)

- BCG & ADDX – Real-World Asset Tokenization: https://www.bcg.com/publications/2022/revolutionizing-real-world-asset-tokenization (Referenced in Blockchain section)

- World Economic Forum – Interoperability in Digital Asset Ecosystems: https://www.weforum.org/whitepapers/interoperability-in-digital-asset-ecosystems (Referenced in Blockchain section)

- World Economic Forum – AI Governance and Financial Services: https://www.weforum.org/whitepapers/ai-governance-and-the-future-of-financial-services (Referenced in AI section)

- European Commission – Proposal for an AI Regulation: https://artificialintelligenceact.eu (Referenced in AI section)

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()