1. Context

In the context of banking and financial regulation in the European Union (EU), a Third-Country Branch (TCB) refers to a branch of a bank that is headquartered outside the EU/EEA but operates within the EU through a local branch rather than a subsidiary.

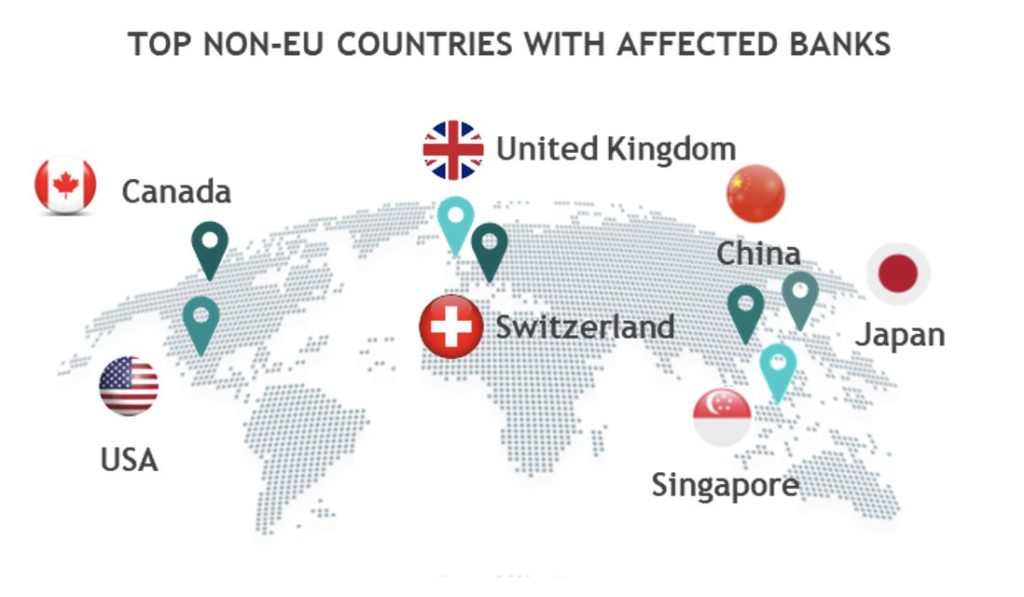

According to the European Banking Authority’s latest update from November 2024, the 439 third-country groups operating in the EU/EEA originate from 50 different countries. Among these, 61 groups have established 95 TCBs across the region.

The map indicates the largest presences of third-country groups come from the United States, United Kingdom, Switzerland, Japan, Canada, China, and Singapore.

2. Introduction

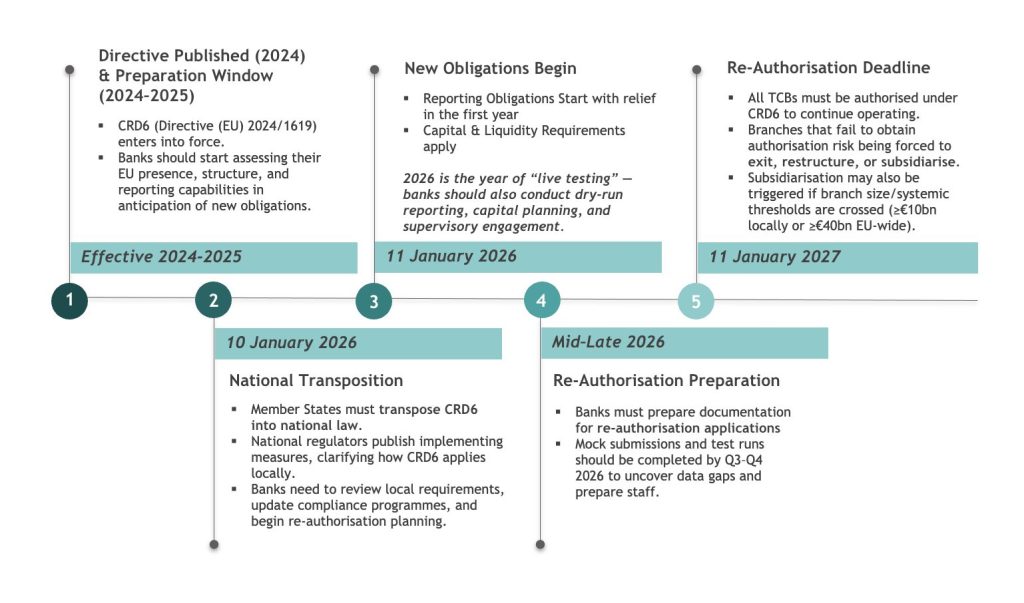

The EU’s new Capital Requirements Directive (CRD6 / Directive (EU) 2024/1619) harmonises rules for third-country banks in the EU. From 11 January 2027, foreign banks can no longer provide core banking services cross-border; they must operate through an authorised EU branch or subsidiary.

For TCBs, this means re-authorisation, flat capital endowment rules, and new reporting requirements. While the legal deadline is 2027, the critical year is 2026: Member States must transpose CRD6 by 10 January 2026, and new reporting obligations begin on 11 January 2026.

3. TCBs classification under new regulations

- Assets threshold: Total value of the assets booked or originated by TCB ≥ €5bn.

- Retail deposits threshold: The amount of TCB’s deposits and other repayable funds is ≥ 5% of TCB’s total liabilities or exceeds €50m.

- Equivalence Status: TCB’s head office is located in a country not deemed equivalent to EU banking regulation by the European Commission (for example, in the UK).

TCB is classified as Class 2 if none of the above conditions are met. These branches are considered smaller and less complex and face lighter regulatory requirements.

4. A New EU-Wide Rulebook

At the heart of CRD6 lies a harmonised framework designed to create a level playing field across the EU.

- Re-Authorisation: Existing TCBs must apply for authorisation to continue offering deposits, lending, or guarantees by 11 Jan 2027. Some “grandfathering” may apply, but most will require re-licensing. Under CRD6, the minimum conditions are published (but will be narrowed by the national competent authorities and EBA):

- Mandatory physical branch establishment.

- Scope of authorization, limited by the particular Member State of its establishment.

- Activities aligned with the home state license.

- Capital & Liquidity requirements (see below).

- Internal governance: at least two local managers, risk management and remuneration policies aligned with EU standards.

- Record-keeping and booking arrangements.

- Reporting obligations (depending on the TCB’s class).

- AML safeguards.

- Cross-Border Restrictions: CRD6 bans non-EU banks from servicing EU clients cross-border, except for:

- Reverse solicitation (client-initiated),

- Interbank transactions,

- Intra-group services.

- Capital & Liquidity: Branches must meet a flat capital endowment:

- Class 2 branches: ≥ 0.5% of liabilities or €5m,

- Class 1 branches:

- ≥ 2.5% of liabilities or €10m,

- plus a 30-day liquidity buffer: TCBs must always maintain a volume of unencumbered and liquid assets sufficient to cover liquidity outflows over a minimum period of 30 days (identical in principle to the LCR requirement).

- Subsidiarisation Trigger: Regulators can force subsidiarisation for branches with assets ≥ €10bn locally or ≥ €40bn EU-wide, or deemed systemic.

- End of Waivers: Countries like Germany must now remove long-standing exemptions that allowed foreign banks to lend cross-border. CRD6 ensures uniform minimum standards across all Member States.

5. The 2026 Challenge

Three main requirements converge in 2026:

1. Re-Authorisation Prep: Governance documents, head-office approvals, outsourcing arrangements, and capital/liquidity proof must be readied for supervisors.

2. New Reporting (from 11 Jan 2026):

- On-/off-balance sheet exposures (by sector & counterparty).

- Head office’s EU assets & liabilities.

- Reverse solicitation transactions.

Templates will be defined in EBA Reporting Framework 4.3, requiring new data feeds and system upgrades (e.g. BAIS).

3. Capital & Liquidity Planning: Branches must align treasury functions and stress tests to the flat 0.5%/2.5% regime and 30-day liquidity requirement.

There are some additional challenges & constraints which will affect TCBs on their way to full compliance with new regulations, mainly:

- Resource Limitations

- For banks with only one EU branch and no subsidiary, the challenge is acute: equal obligations, fewer resources.

- Same for the small branches: they face the same reporting obligations as larger subsidiaries, but with far fewer local staff and infrastructure.

- Data Complexity and Governance

- Extracting granular exposures from global systems is rarely straightforward.

- TCBs must re-engineer processes, ensure clean data flows, and build audit trails for supervisory traceability.

- Balance Sheet Strain

- Local liquidity buffers can disrupt treasury models and increase funding costs.

- Software Readiness

- Reporting tools must be configured to capture CRD6-specific data points under Framework 4.3.

- Early Testing

- Dry runs and mock submissions in 2026 will be essential to identify data gaps, test reconciliations, and familiarise teams before full implementation.

6. How Aspect Advisory Supports Clients

At Aspect Advisory, we work with clients to bridge the gap between regulatory intent and practical implementation. For TCBs, we provide,

- Regulatory Advisory: Guidance on CRD6 authorisation, subsidiarisation risks, capital buffer planning.

- Reporting Implementation: Setup and optimization of reporting tools (including BAIS and others), integration with EBA Framework 4.3, and support for reverse-solicitation reporting.

- Operational Readiness: Project planning for 2026 milestones, test submissions, staff training, and end-to-end assurance.

- Personnel leasing: Provision of skilled staff to support implementation and reporting during peak compliance periods.

We help banks turn compliance into capability — ensuring CRD6 readiness is more than box-ticking.

7. Conclusion

Although CRD6 does not take full effect until January 2027, the real work happens in 2026. For branches with limited resources, the directive presents a significant challenge — but also an opportunity to modernise systems and demonstrate resilience.

By starting early and treating CRD6 preparation as a structured programme, banks can move into 2027 not just compliant but confident. Aspect Advisory is already working with clients to deliver this outcome. For single-branch banks in particular, 2026 will decide your 2027.

Sources:

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()