Introduction

In today’s fast-paced and ever-changing world of banking and finance, operational flexibility and scalability are crucial for staying competitive and meeting customer demands. Managed services, including capacity support, have emerged as essential solutions that help banks navigate these challenges effectively.

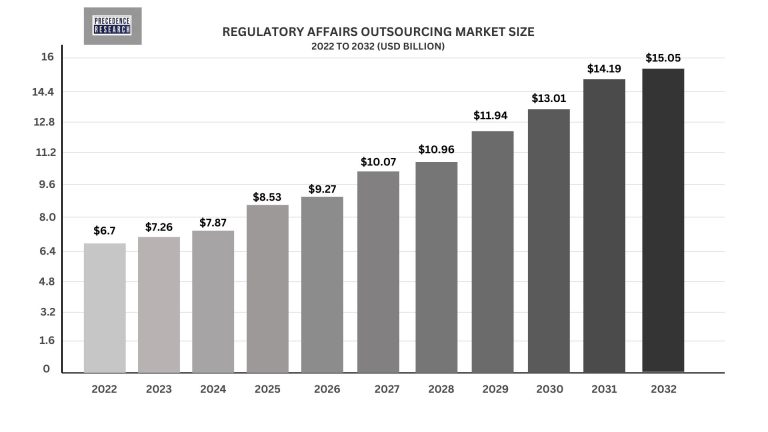

The global regulatory affairs outsourcing market was estimated at USD 6.7 billion in 2022 and is expected to reach USD 15.5 billion by 2032, poised to grow at a compound annual growth rate (CAGR) of 8.8% during the forecast period from 2023 to 2032.

As the managed services market continues to grow at a rapid pace, financial institutions are increasingly turning to these services for support in dealing with the complex world of regulatory reporting. With the regulatory landscape constantly evolving and rules and requirements changing frequently, banks often find themselves struggling to keep up. This is where managed services step in, offering capacity support to ease the burden on financial institutions and ensure compliance with regulations. In this article, we will explore the valuable role that financial consultancies play in providing capacity support through their managed services.

What are Managed Services?

Before delving into the details of capacity support, it’s important to understand what managed services entail. Managed services refer to the outsourcing of certain business operations or functions to external service providers. This allows businesses, such as banks, to focus on their core competencies while leaving specialised tasks in the hands of experts. Managed services can cover a wide range of areas, including IT support, cybersecurity, network management, and capacity planning.

The Role of Managed Services in Regulatory Reporting

In the complex world of regulatory reporting, financial institutions need efficient and effective solutions to comply with the ever-growing number of regulations. Managed services serve as a lifeline, offering vital support and resources to help banks meet their reporting obligations.

By outsourcing the responsibility of regulatory reporting to specialised financial consultancies, banks can alleviate the burden on their internal resources. These consultancies have dedicated teams with expertise in regulatory compliance and reporting. They stay up-to-date with changes in regulations and help financial institutions navigate through the complex landscape.

Additionally, managed services provide access to cutting-edge technology and automation tools that streamline the reporting process. These tools can aggregate and process data from various sources, ensuring accuracy and efficiency in regulatory reporting. By leveraging managed services, banks can free up their internal teams to focus on core business activities, while still ensuring compliance with regulatory requirements.

Data-Driven Analytics for Decision-Making

Regulatory reporting is not just about meeting requirements; it also presents an opportunity for financial institutions to gain valuable insights from their data. By harnessing the power of data-driven analytics, banks can go beyond mere compliance and use their reporting data to make informed decisions and drive business growth.

Data-driven analytics can uncover patterns, trends, and anomalies, in the reporting data, enabling financial institutions to identify and mitigate risks more effectively. It can also provide valuable insights into customer behaviour, market, dynamics, and operational efficiency. With these insights, banks can develop strategies to optimise their processes, enhance customer experience, and make more informed business decisions.

Financial consultancies equipped with advanced analytics capabilities can help banks unlock the hidden potential of their regulatory reporting data. By combining their expertise in financial regulations with sophisticated analytics tools, these consultancies can assist in the interpretations and visualisation of data, enabling banks to extract maximum value from their reporting efforts.

Expertise and Knowledge

Financial consultancies bring deep expertise and knowledge in regulatory reporting to the table. They stay up to date with the latest regulatory developments, ensuring that their clients are aware of any changes that may impact their reporting requirements. This expertise helps banks navigate the complex regulatory landscape with easy, reducing the risk of non-compliance and associated penalties.

Technology Infrastructure

Financial consultancies invest in state-of-the-art technology infrastructure to support their managed services. They offer robust reporting systems and tools that streamline the regulatory reporting process, making it more efficient and accurate. Banks can leverage this technology to automate manual tasks, enhance data quality, and generate comprehensive reports in a timely manner. By providing the necessary technology infrastructure, financial consultancies enable banks to handle regulatory reporting with greater ease and efficiency.

Flexible Resource Allocation

Coping with the workload associated with regulatory reporting can be challenging for banks, especially when faced with limited resources. Financial consultancies understand this challenge and provide flexible resource allocation to address it. They can allocate additional staff or expertise as needed to handle peak workloads or specific reporting requirements. This flexibility ensures that banks always have the capacity and support they need to meet their regulatory reporting obligations.

The Benefits of Capacity Support

The capacity support offered by financial consultancies brings numerous benefits to banks and financial institutions. Some of the key advantages include:

Enhanced Compliance: With the expertise and technology infrastructure provided by financial consultancies, banks can enhance their compliance with regulatory requirements and reduce the risk of penalties.

Cost Savings: By outsourcing capacity support to financial consultancies, banks can avoid the cost of hiring and training additional staff or investing in expensive technology infrastructure.

Time Efficiency: The streamlined processes and automation offered by financial consultancies reduce the time required for regulatory reporting, allowing banks to allocate their resources more efficiently.

Focus on Core Functions: With the capacity support handled by financial consultancies, banks can focus on their core functions and strategic priorities, such as customer service and business growth.

Risk Mitigation: By leveraging capacity support, banks can mitigate the risks associated with sudden surges in demand or unforeseen events. MSPs are equipped to handle disaster recovery and business continuity planning, ensuring that banks can continue their operations seamlessly even in the face of unexpected disruptions.

Conclusion

Managed services and data-driven analytics have transformed the way financial institutions handle regulatory reporting. By leveraging the expertise and resources of financial consultancies, banks can manage regulatory compliance more efficiently, reduce costs, and gain valuable insights from their reporting data. The capacity support provided by managed services enables financial institutions to navigate the ever-changing regulatory landscape with ease, while also driving better decision-making for sustainable growth.

At Aspect Advisory, our expertise in regulatory matters guarantees that our clients adhere to industry standards and regulations, providing them with a sense of reassurance and helping them sidestep any possible obstacles. Additionally, our proficiency in data-driven analytics and strategic decision-making empowers us to offer invaluable insights and assistance to our clients in making well-informed strategic decisions.

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()