California has just dropped a bombshell on the corporate world with the unveiling of The Climate Corporate Data Accountability Act, or as we like to call it, the “Green Giants’ Reality Check.” This game-changing law is a massive leap towards tackling climate change head-on, and it’s got businesses quaking in their eco-friendly boots.

If you’re a big corporation making bank in the Golden State, you better brace yourself because SB-253 is here to keep you on your green toes. It’s like the environmental watchdog that corporations never knew they needed. This legislation is basically the carbon cops, and they are coming for your emissions, whether they’re big, small, or hiding in your supply chain.

Targeting companies with annual revenues exceeding $1 billion (£817 million) that do business in California, this legislation mandates comprehensive disclosure of emissions, spanning direct and indirect sources as well as emissions throughout the supply chain.

What is required?

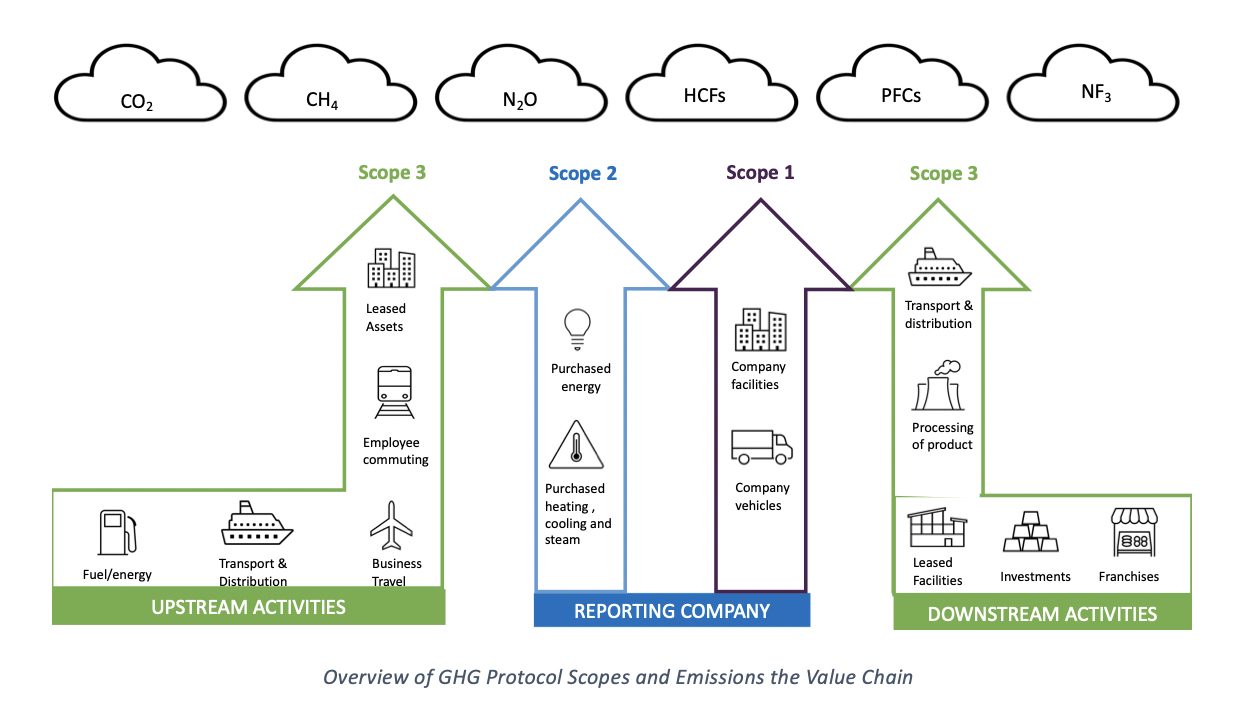

The reporting obligations encompass the three pivotal scopes:

Scope 1: Direct emissions under the ownership or control of the company.

Scope 2: Indirect emissions stemming from energy consumption.

Scope 3: Emissions originating from sources beyond the company’s ownership or control, extending throughout the supply chain.

This reporting framework is carefully designed to align with the globally recognized Greenhouse Gas Protocol standards and guidance. Companies will initiate reporting for Scopes 1 and 2 starting in 2026, providing a crucial baseline for understanding their direct and indirect emissions. Subsequently, Scope 3 emissions will be incorporated into the reporting process from 2027 onwards, offering a more comprehensive view of a company’s overall emissions profile.

Non-compliance with these reporting requirements is likely to carry significant consequences, including penalties, underlining the imperative for corporations to meticulously adhere to the stipulated reporting guidelines and deadlines. The exact regulatory rules and guidelines are yet to be fully articulated. California regulators are mandated to create and finalise these rules by 2025, establishing a clear and comprehensive framework for reporting greenhouse gas emissions.

Is SB-253 Paving the Way for Nationwide Climate Accountability Laws?

The Climate Corporate Data Accountability Act is a pioneering legislative endeavour within the United States. This trailblazing legislation positions California at the forefront of climate accountability, setting a precedent that could inspire other states to follow suit. History illustrates that impactful state laws often serve as models for broader federal regulations. For instance, the California Clean Air Act of 1947 was a precursor to the federal Clean Air Act of 1970. In a similar vein, California’s Global Warming Solutions Act of 2006 catalysed a nationwide movement towards clean energy policies, contributing to the formulation of federal initiatives such as the Clean Power Plan. SB-253, has the potential to ignite a domino effect, encouraging other states to adopt comparable legislation and, eventually, laying the groundwork for a unified, federally mandated approach to corporate climate accountability.

In fact, this momentum aligns with ongoing efforts by the Securities and Exchange Commission (SEC), the US regulator for stocks and markets, which has been actively developing similar federal requirements for companies to report emissions and climate-related risks for over a year. The SEC’s proposed rules would only apply to publicly traded companies, while the Act applies to both publicly traded and privately held companies. Additionally, the SEC’s proposed rules are narrower with respect to which companies will be required to disclose the broader Scope 3 emissions. This convergence of state and federal initiatives underscores a burgeoning consensus on the urgency and necessity of comprehensive climate reporting within the corporate sphere.

International Momentum Towards Emission Reporting Regulations

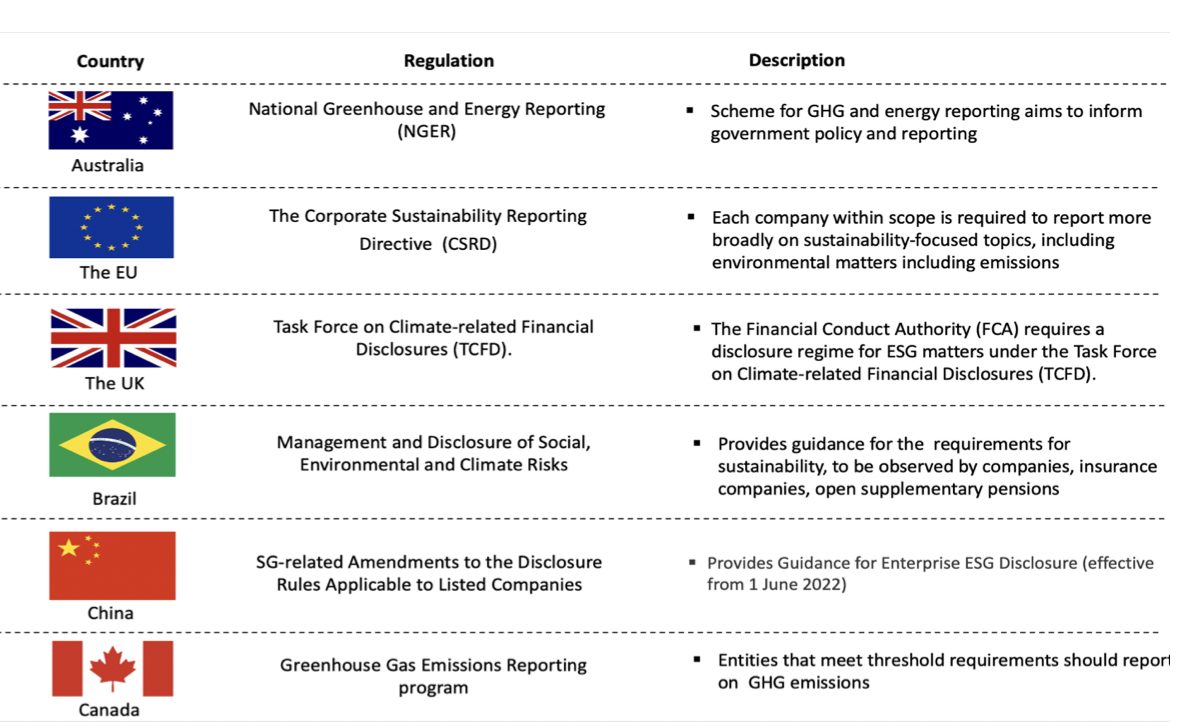

Globally, governing bodies are increasingly embracing disclosure mandates as pivotal legal instruments to drastically mitigate greenhouse gas emissions. SB-253 stands as a noteworthy embodiment of this growing pattern in corporate climate disclosure on an international scale.

The enactment of the California law follows the European Union’s Corporate Sustainability Reporting Directive (CSRD) established in July of this year. The CSRD mandates companies to report greenhouse gas emissions in accordance with European Sustainability Reporting Standards, a subject we explored in depth in a previous article.

Furthermore, the United Kingdom has showcased a parallel commitment to transparency and sustainability through the initiation of the Streamlined Energy and Carbon Reporting (SECR) framework in 2019. This regulatory framework compels large organizations to disclose their energy consumption and greenhouse gas emissions. Notably, incorporated companies in the U.K., listed on major stock exchanges like the London Stock Exchange, European Economic State, NYSE, or NASDAQ, are also obliged to report their emissions in alignment with the Task Force on Climate-related Financial Disclosures (TCFD).

Australia has enforced mandatory emissions reporting under the National Greenhouse and Energy Reporting Scheme (NGERS) since 2007, setting a precedent for comprehensive emissions accountability. Additionally, numerous other countries, including Brazil, Canada, Hong Kong, New Zealand, and Singapore, have expressed intentions to make climate or sustainability disclosures mandatory, further underscoring the global shift towards corporate transparency and environmental responsibility.

The Future of Corporate Climate Disclosure

The trajectory of corporate climate disclosure shows promise and positive development. The momentum witnessed with the enactment of laws such as SB-253, CSRD, and others in various jurisdictions is likely going to continue to prompt more regions and countries to adopt stringent emission reporting regulations.

The integration of sustainability into corporate strategies is poised to intensify, with businesses increasingly recognising the intrinsic link between environmental responsibility and long-term viability. In the coming years, we anticipate a deeper convergence of reporting frameworks, aiming to establish a standardised, globally accepted emissions reporting methodology. Furthermore, audits focusing on ESG factors, including emissions, are projected to become commonplace, reflecting the growing influence and significance of sustainability metrics in evaluating a company’s overall performance. Ultimately, this drive towards transparency and sustainability lays the foundation for a future where corporations are not only accountable for their emissions but are actively committed to comprehensive environmental stewardship.

What Are We Doing to Assist Our Clients in This Area?

At Aspect Advisory we recognise the critical role financial institutions play in achieving sustainability goals and mitigating climate risks. Our commitment extends beyond providing financial services; we are dedicated to assisting our clients in navigating the evolving landscape of emissions reporting and environmental accountability. Our team of experts is well-versed in the intricacies of emerging regulations. We tailor our financial consulting services to help clients align with these frameworks, ensuring accurate reporting and strategic decision-making. By integrating financial expertise with a deep understanding of environmental disclosures, we empower our clients to thrive in a sustainable future.

Contact us

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()

Stuart Thomson