1. What is it?

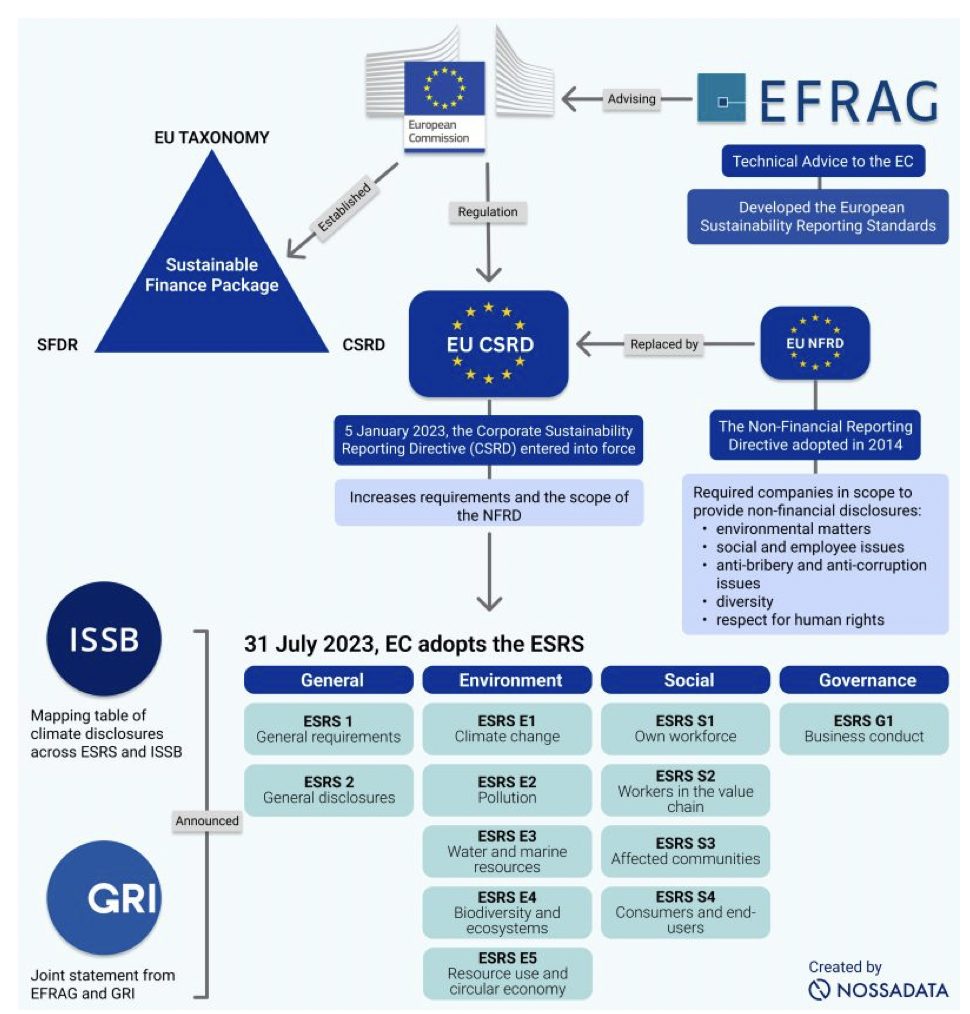

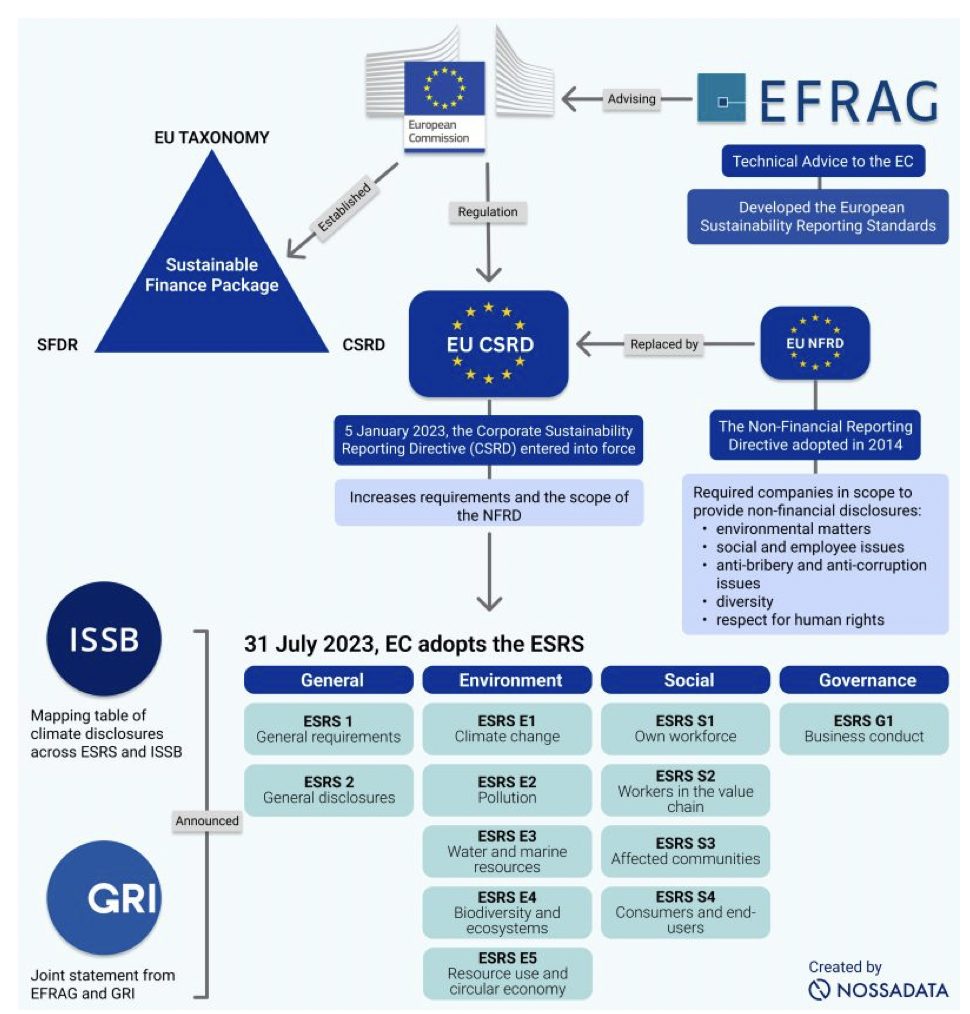

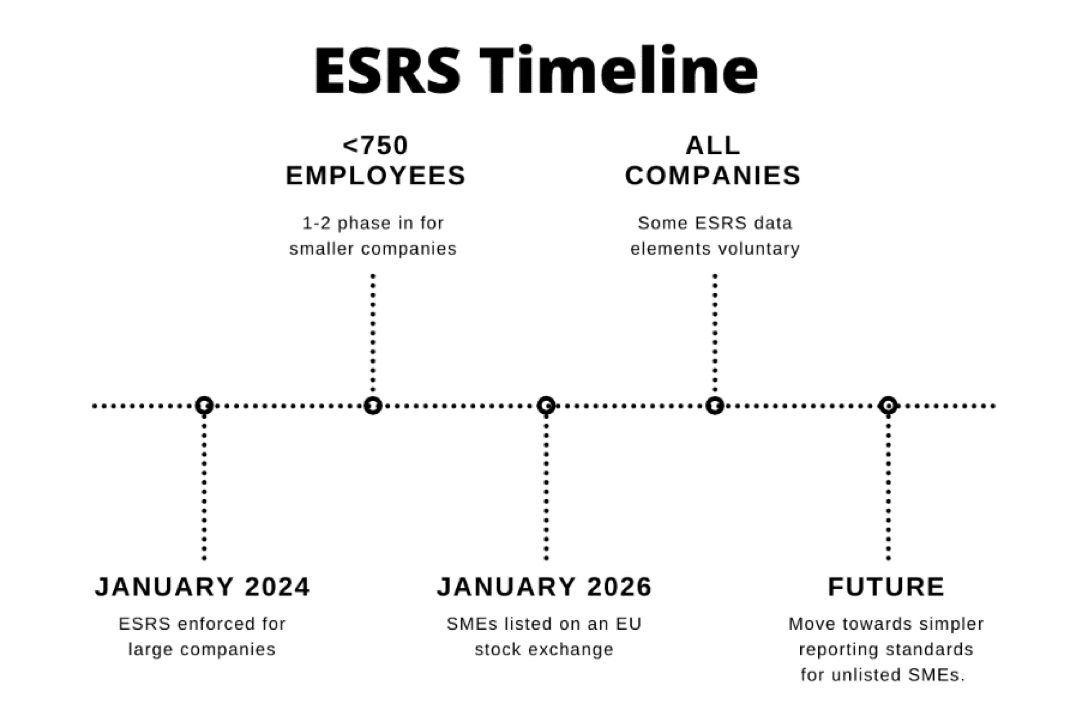

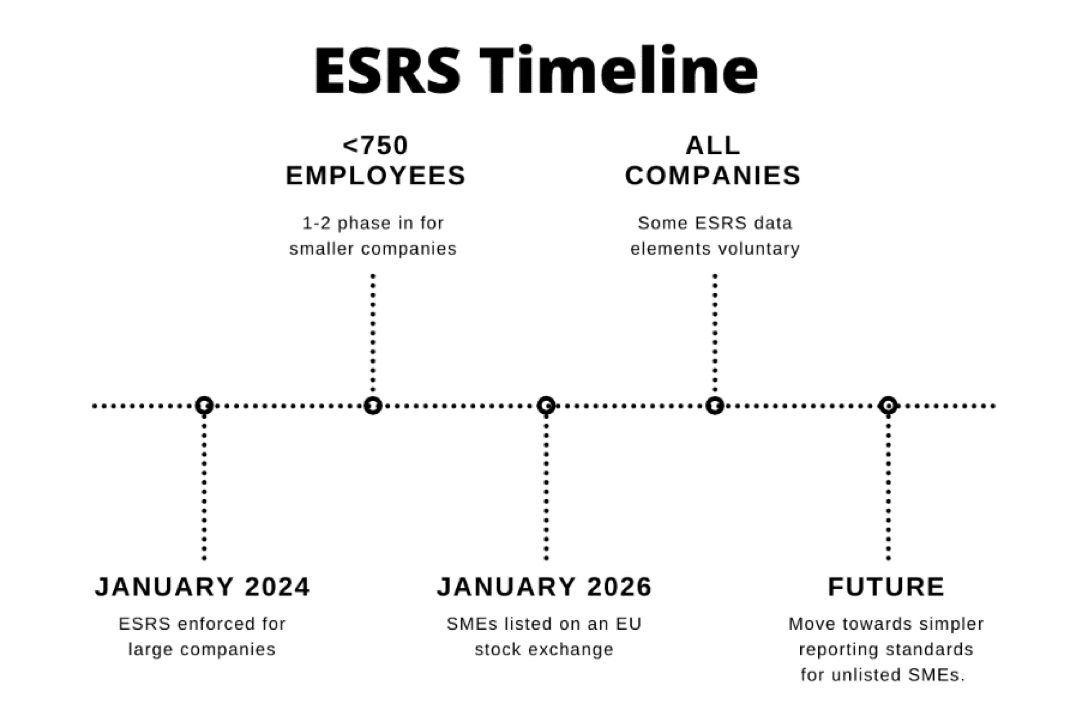

The Corporate Sustainability Reporting Directive (CSRD) went into effect on January 5 2023 to reinforce the reporting requirements for social and environmental reporting and requires companies to make extensive, detailed disclosures about sustainability performance and related strategic implications. The aim of the CSRD is to bring sustainability reporting on par with financial reporting and serves as a framework to which certain reporting standards fit into. On July 31, 2023, the European Commission (EC) enacted the first set of 12 European Sustainability Reporting Standards (ESRS) for use by all organisations subject to the CSRD[1]. By mandating the use of common standards, the Accounting Directive, as amended by the CSRD in 2022, seeks to ensure that companies across the European Union (EU) report comparable and trustworthy sustainability reporting. The ESRS are defined as the sustainability reporting requirements to meet the CSRD. Now, a broader range of large corporations, in addition to publicly traded SMEs, will be required to report on sustainability.

2. Why?

To operate in an environmentally, socially, and economically sustainable manner is one of the most pressing challenges that organisations, including the public sector, face (Hopwood et al., 2010). The ESRS were created to support the European Grean deal and align with existing sustainability frameworks such as the EU Taxonomy[2]. Concerns over the social and environmental impacts of organizational activities have increased the need to measure and disclose sustainability performance. Sustainability reporting, which is “the practice of measuring, disclosing, and being accountable to internal and external stakeholders for organizational performance toward the goal of sustainable development,” is used by organisations to demonstrate their sustainability performance[3]. Various categories of reports have been published by businesses to provide stakeholders with a clear picture of their sustainability practices (Tsalis et al., 2020). Others emphasize the social dimension (social or corporate social responsibility [CSR] reports) whilst others on environmental. The variation in corporate sustainability reports may be explained by the varying influence of stakeholders on corporate operations (Weber & Marley, 2012) and by the evolution of the sustainable development concept, which stipulates the conditions under which firms must operate. Inadequacies in the integrity of sustainability reporting have significant ramifications. It implies that investors lack a reliable overview of sustainability-related hazards to which companies are exposed. Investors should be made increasingly aware of the impact of businesses on people and the environment, as well as their plans to reduce these impacts in the future. This information will assist them in meeting their own disclosure obligations under the Sustainable Finance Disclosure Regulation (SFDR)[4]. Generally speaking, if the market for green investments is to be credible, investors must understand the sustainability impact of the companies in which they invest. Without such data, funds cannot be allocated to environmentally friendly activities.[5]

[1]

The Commission adopts the European Sustainability Reporting Standards. https://finance.ec.europa.eu/news/commission-adopts-european-sustainability-reporting-standards-2023-07-31_en.

[2] The EU taxonomy is a cornerstone of the EU’s sustainable finance framework and an important market transparency tool. It helps direct investments to the economic activities most needed for the transition, in line with the European Green Deal objectives. https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

[3]GRI (2013), Sustainability Reporting Guidelines: Version 4, Global Reporting Initiative, Amsterdam. Pg3

[4] Sustainability-related disclosure in the financial services sector – How financial market participants and financial advisers have to communicate sustainability information to investors. https://finance.ec.europa.eu/sustainable-finance/disclosures/sustainability-related-disclosure-financial-services-sector_en

[5] Why is the Commission adopting European Sustainability Reporting Standards (ESRS)? https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043.

[1]

The Commission adopts the European Sustainability Reporting Standards. https://finance.ec.europa.eu/news/commission-adopts-european-sustainability-reporting-standards-2023-07-31_en.

[2] The EU taxonomy is a cornerstone of the EU’s sustainable finance framework and an important market transparency tool. It helps direct investments to the economic activities most needed for the transition, in line with the European Green Deal objectives. https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

[3]GRI (2013), Sustainability Reporting Guidelines: Version 4, Global Reporting Initiative, Amsterdam. Pg3

[4] Sustainability-related disclosure in the financial services sector – How financial market participants and financial advisers have to communicate sustainability information to investors. https://finance.ec.europa.eu/sustainable-finance/disclosures/sustainability-related-disclosure-financial-services-sector_en

[5] Why is the Commission adopting European Sustainability Reporting Standards (ESRS)? https://ec.europa.eu/commission/presscorner/detail/en/qanda_23_4043.

The ESRS encompass the entire spectrum of environmental, social, and governance concerns, such as climate change, biodiversity, and human rights as depicted in Figure 1 below. In addition, they take into account discussions with the International Sustainability Standards Board (ISSB) and the Global Reporting Initiative (GRI) to ensure a very high degree of interoperability between EU and global standards and to prevent double reporting by corporations.

3. Aims

- Reduce reporting costs in the medium and long term, by avoiding the use of multiple voluntary standards by multi-national organisations as this is the case today. ESRS aligns with the new IFRS S1 and S2 reporting requirements to avoid double work[6].

- Reduce accountability gap caused by problems in the quality of sustainability reporting. There are differences in the breadth and the quality of information disclosed by firms.

- High quality and reliable public reporting by companies will help create a culture of greater public accountability and comparability.

[6] ISSB issues inaugural global sustainability disclosure standards – IFRS S1 and S2

https://www.ifrs.org/news-and-events/news/2023/06/issb-issues-ifrs-s1-ifrs s2/#:~:text=IFRS%20S1%20provides%20a%20set,be%20used%20with%20IFRS%20S1.

4. Key changes to ESRS Standards

In November 2022, the European Financial Reporting Advisory Group (EFRAG) released proposed ESRS [7], and the European Commission held discussions on these new regulations. The following significant revisions were made to the previously released draft standards:

4.1 Materiality

Companies will be required to provide information about matters deemed relevant, with consideration given to the impact on people as well as environmental, social, and governance (ESG) problems that pose financial risks. Except for ‘General obligations’ and ‘General Disclosures’ Standards; ESRS 1 and ESRS 2, all ESRS are subject to a materiality evaluation by the reporting organization, including all disclosure obligations and data points provided within each Standard. It is anticipated that the reporting entity burden associated with CSRD disclosures would be greatly reduced as a result of this revised requirement. Companies will have to choose what information to disclose by applying the double materiality approach, which calls for the disclosure of data that is significant from both a financial and an impact standpoint. Information on the company’s value chain should also be included. However, when companies conclude that an ESRS is not material, they will have to provide a detailed explanation of their conclusion for auditors to verify its rationale.

4.2 Voluntary disclosures

Many disclosures and datapoints that were required in the initial version of the ESRS have been deemed optional by the EC. Indicators pertaining to “non-employees” of the enterprise’s own workforce and an explanation of why the undertaking does not consider a certain sustainability concern to be relevant, biodiversity transition plans (ESRS E4) etc.

4.3 Phasing-in reliefs

To aid reporting organisations, especially smaller firms that would be subject to sustainability reporting obligations for the first time, the EC has allowed some extra phasing-in beyond what was requested by EFRAG. The EC’s new, more gradual phase-in consists of:

N.B – firms with less than 750 workers.

- Scope 3 GHG emissions data and the disclosure criteria stipulated in the standard on ‘Own Workforce’ may be omitted for the first year of applying the standards by reporting

- In the first two years of implementation, the standards’ disclosure obligations to employees in the value chain, affected communities, and customers and end-users are in effect.

5. Next Steps

The soon-to-be-released interoperability advice information from the EC, EFRAG, and ISSB should help entities find their way between the standards and learn where there are additional or different disclosures needed. The EFRAG recently made accessible documents on the compatibility of ESRS with the GRI standards and the IFRS sustainability disclosure requirements. The public session of the EFRAG SRB (Sustainability Reporting Board) was held on August 23, 2023. Additional standards for sector-specific, SMEs and non-EU parent companies requirements are yet to be developed for later adoption.

We are excited to help our existing and potential clients with the transition to implement the applicable ESRS to the scope of their business as we have successfully carried out related exercises such as climate-risk testing. Contact us at climate@www.aspectadvisory.eu or info@www.aspectadvisory.eu today to find out more about how these standards affect your organisation.

References

Hopwood, A., Unerman, J. and Fries, J. (2010), “Introduction to the accounting for sustainability case studies”, in Hopwood, A, Unerman, J and Fries, J (Eds), Accounting for Sustainability: Practical Insights, Earthscan, London, pp. 1-28.

Tsalis, T. A., Malamateniou, K. E., Koulouriotis, D. E., & Nikolaou, I. E. (2020). New challenges for corporate sustainability reporting: United Nations’ 2030 Agenda for sustainable development and the sustainable development goals. Corporate Social Responsibility and Environmental Management, 27(4), 1617–1629. https://doi.org/10.1002/csr.1910

Weber, J., & Marley, K. A. (2012). In search of stakeholder salience: Exploring corporate social and sustainability reports. Business & Society, 51 (4), 626–649. https://doi.org/10.1177/0007650309353061

Contact us:

Stuart Thomson

Partner,

Aspect Advisory

![]()

Contact us: