Introduction

As the world gears up for the 28th UN Climate Change Conference (COP28), we are reminded of the critical juncture we face in our collective fight against climate change. Nearly eight years after the historic Paris Agreement, COP28 stands out for hosting the first-ever “Global Stock Take” – a comprehensive assessment of global progress and a call to action for more decisive climate measures.

The Global Stock Take is a two-year process set to be completed every five years. The first Global Stock Take begun in 2022, with its conclusion coinciding with this upcoming COP28 conference. The objective of this global gathering is to coordinate national efforts on climate action, including measures to bridge the gaps in progress.

The preliminary findings from the Global Stock Take indicate that the global community is lagging in meeting the goals set out in the Paris Agreement. The highest-level goal is to keep global warming under 2°C while pursuing efforts to stay within 1.5°C.

The focus of the COP28 conference in Dubai, United Arab Emirates, will be on how nations use the results of the Global Stock Take Report to address the effects of climate change and maintain the global objective of keeping temperature rise to 1.5°C.

Reflecting on the Paris Agreement:

The Paris Agreement, adopted at COP21 in 2015, was a landmark in international climate policy, marking the first-time countries committed to limiting global temperature rise well below 2°C. The spirit of cooperation was palpable, as governments and non-state actors across the globe came together in an unprecedented commitment to a sustainable future. Because of its global nature and inherent complexity, addressing climate change hinges on the ability of countries to come together to find solutions at the required scale. Cooperation is a key determinant of the effectiveness of environmental treaties.

The Global Stock Take emphasizes the urgency of action to mitigate global warming. It’s now ever more important for international cooperation, equitable climate action, and sustainable transformation across all sectors.

What is the progress of the net zero transition within sectors globally:

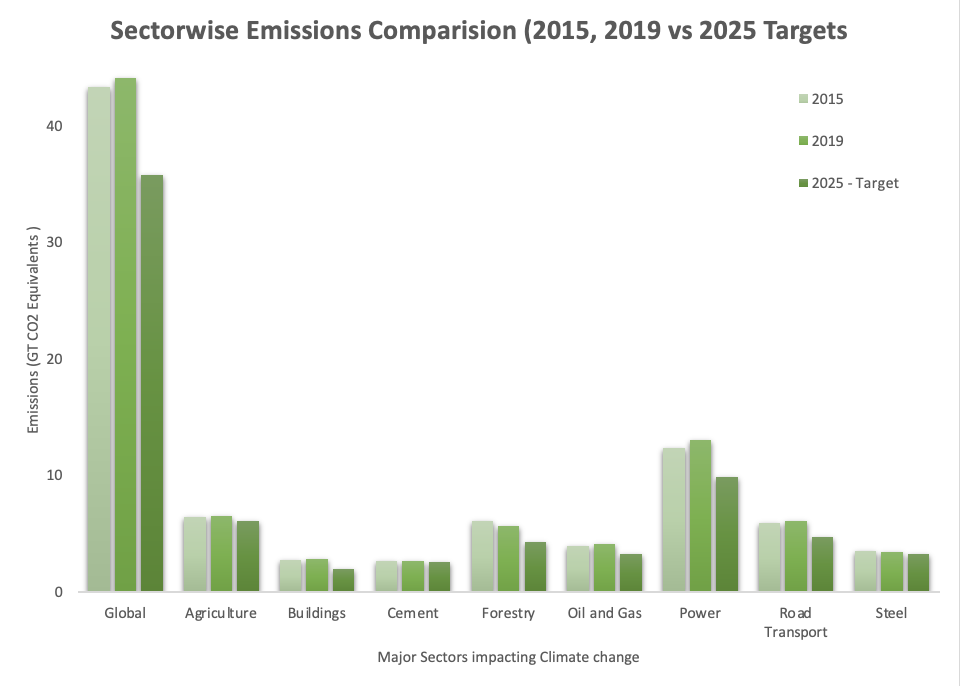

According to the McKinsey Emissions Tracker (2019) and in line with 1.5°C Scenario analysis, the ten sectors featured in the tracker—power, road transport, maritime transport, aviation, oil and gas, steel, cement, buildings, agriculture, and forestry— accounted for roughly 80% of the world’s greenhouse-gas emissions in 2019 alone, as depicted in below. These results clearly indicate that in most sectors, emissions have increased, widening the gap to the target, except for Forestry where emissions reduced, but not at the target rate, and Steel which also showed a reduction in emissions.

Figure 1: Sector-wise Emissions Comparison for 2015, 2019 and 2025

- non-CO2 emissions are converted into carbon dioxide equivalents according to their 100-year global warming potential (GWP100)

- Emissions rounded to nearest 5 MtCO2 equivalent

- Source: McKinsey Emissions Inventories Tracker, McKinsey 1.5C scenario analysis

Assessing the progress on a sectoral level towards the reduction in global emissions is a complex challenge. A useful framework to consider when tackling this problem considers nine crucial elements. These elements are segmented into the three categories of Physical building blocks, Economic and Societal adjustments, and Governance:

Physical Building Blocks

- Technological advancements

- Creating supporting infrastructure

- Availability of essential natural resources

Economic and Societal Adjustments

- Efficient capital reallocation and financing models

- Managing demand shifts and initial increases in unit costs

- Creating compensatory measures to mitigate socioeconomic effects.

Governance:

- Setting governing standards, tracking, market mechanisms, and strong institutions

- Commitment and cooperation among leaders from public, private, and social sectors worldwide

- Gaining support from citizens and consumers.

Physical Building Blocks

- Technological advancements

- Creating supporting infrastructure

- Availability of essential natural resources

Economic and Societal Adjustments

- Efficient capital reallocation and financing models

- Managing demand shifts and initial increases in unit costs

- Creating compensatory measures to mitigate socioeconomic effects.

Governance:

- Setting governing standards, tracking, market mechanisms, and strong institutions

- Commitment and cooperation among leaders from public, private, and social sectors worldwide

- Gaining support from citizens and consumers.

Figure 2: A Framework towards an Orderly transition to a Net Zero Future (Source: McKinsey and Company, 2021)

Given this context, the global progress and readiness for net-zero transition is evidently behind schedule, yet there is notable potential in the physical building blocks category. Analysing the outcomes of this preliminary assessment reveals three crucial insights, highlighting the urgency for immediate action and exposing disparities across various sectors and requirements:

The progress towards achieving net-zero emissions by 2050 is lagging, with the world risking further delay. Present emission reduction efforts indicate a significant gap compared to the required levels for reaching net zero by the target year. Overall, global readiness for this transition appears to be only about one-third to half of what’s needed for a smoother transition, especially when the various criteria are given equal importance. This gap could widen if factors like financing are given more emphasis. Nonetheless, some areas within the nine criteria show promising strengths.

- The implementation of technological advancements towards net zero transition demands coordinated support across several key requirements, most notably among these being expandable supply chains and the availability of robust financing. Additionally, it necessitates the readiness and commitment of both businesses and consumers to facilitate the transition. This includes further technological advancements and various strategies to reduce costs, bridge the performance gap with conventional options, and in some instances, the capacity to bear extra expenses.

- Stakeholders can take immediate actions that not only cut emissions and boost resilience but also facilitate a smoother energy transition. Despite the challenges faced in the short and long term on the journey to net zero, there exist several clear and immediate opportunities for leaders to capitalize on right now, alongside efforts to hasten the transition. These opportunities, which are relatively straightforward to implement, often help in reducing emissions, lowering costs, and enhancing energy resilience. Examples include initiatives to improve energy efficiency (such as in the buildings sector or in industry), promoting circularity to decrease both energy and materials use, and actions to reduce methane emissions in current fossil fuel operations. These measures are particularly vital considering the time required to accumulate or redirect sufficient capital from high-emission to low-emission assets across various industries.

The Criticality of COP28:

The inaugural Global Stock Take, recently released in October 2023, highlights that the world is behind track to realise the objectives of the 2015 Paris agreement. At COP28, UN member states will further unpack their individual and collective responses to the Stock Take’s findings. These discussions will likely yield the following outcomes:

Specific targets will be agreed upon across the energy sector (including solar and wind energy, coal, hydrogen, oil, and gas). The Global Stock Take places a strong emphasis on the importance of a global energy transition in achieving net zero, highlighting the importance of setting tangible goals within the energy sector throughout this process.

Scalable financing mechanisms to facilitate global climate adaptation efforts are established, particularly for the countries at most risk, as member states realise the gaps in action and implementation directly attributable to financial constraints.

Strategies to bring the global private sector on board with climate action will be created (including finance, accountability, capability building, and technology).

A call to action for Member states to strengthen actions toward nationally determined contributions, with priority placed on equity and historical responsibility especially from developed countries.

Key Areas of Focus at COP28:

- Adopting a Transformational Response to the Global Stock Take:

The Stock Take moves from a technical phase to a political one at COP28. It’s crucial for countries to not only acknowledge gaps in action and financing but also to set clear, ambitious steps forward.

- Accelerating Systems Transformation:

COP28 must address the urgent need to transform global systems, particularly signalling the end of the fossil fuel era. Discussions around phasing out or phasing down fossil fuels and the role of carbon capture technologies are central to these transformations.

- Strengthening Climate Finance Commitments:

Adequate financial support for developing countries is critical. COP28 should focus on reaffirming and scaling up the $100 billion annual climate finance commitment and advancing discussions on loss and damage finance.

- Enhancing Global Collaboration for Adaptation and Resilience:

Investment in adaptation and resilience strategies is essential, especially for vulnerable regions. COP28 should foster frameworks for global collaboration in integrating adaptation into climate policies.

How global transition towards net zero impacts players within the financial industry?

Global net-zero transition efforts will continue to take shape, as catalysed by events like COP28. However, the portfolios of financial institutions across the board are increasingly exposed to climate risk and utilize stress testing to effectively measure their exposure to climate risk. Over the past year, significant institutions have shown considerable progress in developing frameworks for climate risk stress testing. According to the European Central Bank’s report from November 2021, only about 25% of institutions had conducted ad hoc climate risk-related stress tests, scenario analyses, or sensitivity analyses. Additionally, a mere 13% had begun incorporating climate risks into their regular stress-testing frameworks.

However, by the end of 2021, as per the 2022 Climate Stress Test (CST) findings, approximately 40% of banks reported having a climate risk stress-testing framework in place as of December 31, 2021. The involvement in the 2022 CST may have spurred many institutions to integrate climate risk more broadly into their stress-testing frameworks. Despite this progress and acknowledging likely differences in the thoroughness and completeness of banks’ stress testing practices, most institutions still have not fully incorporated a climate risk stress-testing framework into their Internal Capital Adequacy Assessment Process (ICAAP) and broader stress-testing frameworks.

At Aspect Advisory, we recognise the urgency highlighted by the Global Stock Take and how climate risk stress testing facilitates the global transition towards net zero emissions. Our ESG practice, particularly in climate risk stress testing, aligns with these global priorities by enabling our clients to have oversight over the extent to which their portfolios are exposed to climate risk, facilitating targeted risk management and optimization. We are dedicated to guiding our clients through this rapidly evolving landscape, ensuring their strategies are robust, sustainable, and forward-thinking.

Conclusion

COP28 represents more than just another conference; it’s a pivotal moment to catalyse global climate action. In the Over the last decade, there has been a significant reduction in the costs of renewable energy sources: wind energy has become 70% cheaper, and solar power has seen a 90% decrease in price. There’s also noticeable shift in the global governance approach to climate change. Politicians are now actively campaigning on this issue, moving away from previous tendencies to ignore or deny it. The passage of climate legislation by the US Congress, once deemed unlikely, marks a significant change.

While it’s possible to continue highlighting alarming predictions about a future impacted by climate change, there’s a more hopeful narrative emerging. We are at a unique moment in human history, with a chance to address climate change and avert its most severe consequences. There is a lot of reason to be optimistic about our climate future. The success of COP28 hinges on collective efforts to embrace transformative changes across all sectors, underpinned by enhanced cooperation and finance. It’s a call for us to rise to the challenge, turning ambitions into tangible actions for a sustainable future.

Sources:

- Mckinsey & Company (2023), “What is the global stock take?”

- United Nations Framework Convention on Climate Change (2023) “Why the Global Stocktake is Important for Climate Action this Decade?”

- International Institute for Sustainable Development (2023), 2023 UN Climate Change Conference (UNFCCC COP 28)

- Mckinsey & Company (2023), A sector progress tracker for the net-zero transition

- European Central Bank (2022), 2022 climate risk stress test

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()