Introduction

The European Central Bank (ECB) has reaffirmed its commitment to addressing the multifaceted challenges posed by the climate crisis. In this article, we explore the ECB’s strategic framework for addressing climate change, focusing on three critical areas for 2024 and 2025: the transition to a green economy, the physical impact of climate change, and the risks of nature loss and degradation.

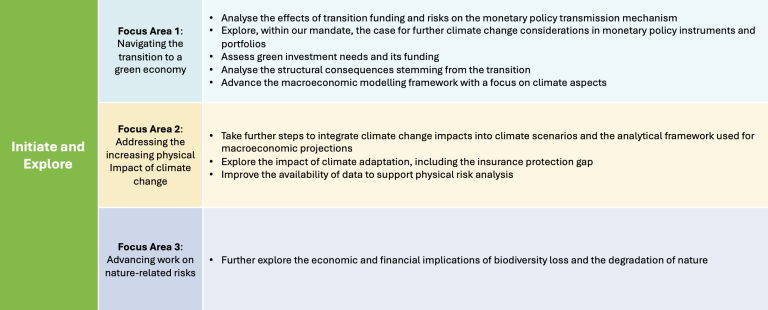

ECB Focus Areas for 2024 and 2025

1. Transition to a green economy

ECB’s first focus area is directed towards the transition to a green economy. Central to this, is a comprehensive understanding of transition funding dynamics and the pressing investment needs in sustainable initiatives. Moreover, the ECB aims to delve into the repercussions of the green transition on critical economic components such as labour markets, productivity levels, and overall economic growth. In alignment with these efforts, the ECB is poised to explore potential adjustments to its monetary policy instruments and portfolios, ensuring their coherence with environmental imperatives and facilitating the transition towards a greener economy.

The ECB’s focus on the transition to a green economy is in line with other global efforts to address climate change. Many central banks and financial institutions worldwide are increasingly recognising the importance of integrating climate considerations into their policy frameworks and operations. For instance, the Bank of England and the Federal Reserve have also been actively exploring the implications of climate change for monetary policy and financial stability. This global trend underscores the growing recognition of the need to align financial systems with environmental objectives and support the transition to a more sustainable economy.

2. Physical Impact of Climate Change

The second focus area delves into the increasing physical impact of climate change and its ramifications for economic and financial stability. With extreme weather events becoming more frequent and severe, the ECB aims to deepen its analysis of their implications on inflation dynamics, financial market volatility, and systemic risk. By integrating climate scenarios into its macroeconomic projections, the ECB seeks to enhance its capacity to anticipate and mitigate the adverse effects of climate-related shocks. Additionally, the ECB is keen to assess the potential impact of adaptation—or the lack thereof—to climate change on the economy and financial sector. This entails examining investment needs for climate resilience, evaluating the efficacy of existing adaptation measures, and addressing the widening insurance protection gap. By proactively addressing the physical risks posed by climate change, the ECB aims to bolster the resilience of the financial system and support sustainable economic development.

The ECB has been at the forefront of central banks by embracing climate stress testing methodologies to evaluate the financial system’s resilience to climate risks. In a notable stride, the ECB published its second economy-wide climate stress test in September 2023 which covered both physical and transition risks. Within the second focus area, climate stress testing is set to assume a crucial role, offering invaluable insights into the potential ramifications of extreme weather events and enduring climate patterns on financial institutions and markets.

3. Nature loss and Degradation

The third focus area revolves around the interconnected challenges of nature loss and degradation. The ECB recognises the close linkages between biodiversity loss, ecosystem degradation, and climate-related risks, necessitating a comprehensive analysis of their economic and financial implications.

By assessing the risks associated with nature loss and degradation, the ECB aims to enhance its understanding of their potential systemic impacts and inform its policy responses accordingly. Through collaborative research and engagement with stakeholders, the ECB endeavours to promote the preservation and restoration of natural capital as a vital component of sustainable development.

Concrete Measures Actions and Future Commitments

The ECB’s commitment to addressing climate change is underscored by concrete measures and actions, aligning with its mandate and strategic objectives. These initiatives are complemented by a steadfast commitment to future actions, ensuring continuous adaptation and responsiveness to evolving environmental challenges.

ECB Climate and Nature Plan 2024-2025 Roadmap

Conclusion

The European Central Bank (ECB) has firmly established its role in tackling the pressing issues of climate change and environmental sustainability. The institution has not only committed itself to proactive measures but has also highlighted the urgent need to address the risks associated with climate change. These focused efforts are instrumental in steering the European financial sector towards sustainability and resilience. By integrating climate risks into its monetary policy and stress testing the financial system, the ECB demonstrates its commitment to shaping a robust and environmentally-aligned economy for the coming years.

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()