I. Introduction

In today’s financial landscape, strong balance sheets and positive earnings forecasts are no longer the only factors that determine the success of financial services organisations. Stakeholders, including investors and customers, are increasingly evaluating firms based on their commitment to addressing broader economic and societal challenges. Environmental, social, and governance (ESG) considerations have become a significant parameter in evaluating the sustainability and responsible business practices of financial institutions. For example, a study by Harvard Business School found that companies with high ratings on material ESG issues had significantly higher future stock returns and profitability compared to companies with low ratings on these issues[1].

ESG stands for Environmental, Social, Governance and refers to a set of criteria used to assess the sustainability and ethical impact of an investment, business decision or whole company beyond the sole criteria of shareholder value. ESG factors take into consideration a company’s performance and behaviour related to environmental impact, social responsibility, and corporate governance practices. Ignoring ESG factors might backfire through increased losses from environmentally unfriendly, socially doubtful and/ or poorly governed business and funding models.

Increasingly, ESG has become a critical consideration for financial institutions and investors as they seek to align their practices with their values and mitigate risks associated with environmental and social issues, such as climate change, pollution, labour practices, human rights, diversity, and corporate ethics. Regulatory bodies in many countries have implemented or proposed regulations that require companies to disclose their ESG practices, further driving the importance of ESG in financial decision-making.

The extent to which a financial firm is environmentally and socially responsible mainly depends on how environmentally and socially responsible the projects it funds, invests in, and provides collateral for are. The way the financial firm supports businesses, projects, vehicles, and properties through its funding plays a big role in spreading good practices related to the environment, society, and governance to many other firms. This means that financial firms can significantly help promote positive practices across a large number of other companies.

This article will delve into the evolving landscape of ESG regulation. We will explore the challenges that financial institutions face in meeting these regulatory obligations and highlight how our consulting company can provide tailored solutions to help banks and financial institutions navigate the complexities of ESG reporting.

As the importance of ESG continues to grow in the financial sector, understanding and complying with ESG regulations is becoming crucial for financial institutions seeking to demonstrate their commitment to sustainability and societal responsibility.

[1] Mozaffar Khan, George Serafeim, and Aaron Yoon. Corporate Sustainability: First Evidence on Materiality.

The Accounting Review, Vol. 91, No. 6, November 2016

II. Overview of ESG Regulation Internationally

The global regulatory landscape of ESG factors for financial institutions is evolving rapidly. While specific regulations and requirements vary by jurisdiction, there are some general trends internationally:

- Disclosure Requirements

Many regulatory bodies, stock exchanges, and other government agencies around the world are introducing or enhancing disclosure requirements related to ESG risks for financial institutions. These requirements typically involve disclosing information about how financial firms identify, assess, manage, and report on ESG risks in their operations, investments, and lending activities. These disclosures are aimed at promoting transparency and accountability and providing investors and other stakeholders with information to assess the ESG risk profile of financial institutions.

- Prudential Supervision

More regulatory bodies are incorporating ESG risk considerations into their prudential supervision of financial institutions. This often involves having financial instituions assess the adequacy of risk management frameworks and processes for identifying, measuring, and mitigating environmental, social and governance factors among their borrowers (financial firms lend to) and issuers (financial firms invest in their stocks and bonds), as well as evaluating the potential impact of high ESG risks on the financial soundness and stability of financial institutions. While no global ESG prudential standards of supervision currently exists, several regulators have set expectations for the management of ESG-related risks. For instance, the European Banking Authority (EBA) expects EU banks to fully integrate Environmental, Social and Governance (ESG) risks into their disclosures of prudential information[2]. This regulation requires banks to disclose both qualititative and quantitavtive metrics such as the Green Asset Ratio. The green asset ratio (GAR) is a financial measure used to assess the sustainability of a company or investment portfolio. It is calculated by dividing the total value of a company’s or portfolio’s environmentally friendly assets by the total value of all of its assets.

Overall, there is a strong focus on the ‘E’ in ‘ESG’, covering climate and other environmental risks, with supervisory authorities in several countries designing and implementing stress tests for climate risks.

- Sustainable Finance Regulations

There is a growing trend towards the development of sustainable finance regulations, which aim to promote sustainable investments and align financial flows with environmental and social objectives. The main difference between ESG and sustainable finance is that ESG is a framework for evaluating sustainability, while sustainable finance is the investment of capital in sustainable companies and projects. ESG can be used to assess the sustainability of any company or investment, while sustainable finance is typically used to invest in companies and projects that are considered to be leaders in sustainability. ESG and sustainable finance are both important tools for promoting sustainability. ESG can help companies to identify and address sustainability risks, while sustainable finance can help to channel capital to companies and projects that are working to create a more sustainable future.

Following the adoption of the 2016 Paris agreement on climate change many regulators set intentions to increase transparency in the field of sustainability risks and sustainable investment opportunities. As such regulators are trying to determine what actions and projects can truly be considered environmentally sustainable and which ones cannot through taxonomies. The EU Taxonomy is currently the most comprehensive taxonomy. It is a classification system that defines criteria for economic activities that are aligned with climate change mitigation and adaptation, and other environmental objectives. It is designed to help investors, companies, and policymakers identify and invest in sustainable activities.

Other sustainable finance regulations include measures such as establishing green or sustainable finance frameworks, creating tax incentives for sustainable investments, or setting standards for green bonds and other sustainable financial products, for instance, the EU commission establishing a unified classification system of sustainable economic activities, called the EU taxonomy[3].

A taxonomy classifies products and services into ESG friendly and ESG unfriendly. The ESG friendly ones are promoted as part of the strategic cycle.

[2] European Banking Authority. Implementing Technical Standards (ITS) on prudential disclosures on ESG risks in accordance with Article 449a CRR. https://www.eba.europa.eu/implementing-technical-standards-its-prudential-disclosures-esg-risks-accordance-article-449a-crr

[3] European Commission. EU taxonomy for sustainable activities. https://finance.ec.europa.eu/sustainable-finance/tools-and-standards/eu-taxonomy-sustainable-activities_en

A taxonomy classifies products and services into ESG friendly and ESG unfriendly. The ESG friendly ones are promoted as part of the strategic cycle.

- International Standards and Guidelines

Various international organisations and initiatives have developed standards and guidelines related to ESG risk for financial institutions. These include the Task Force on Climate-related Financial Disclosures (TCFD), the Principles for Responsible Investment (PRI), the Global Reporting Initiative (GRI), and the Sustainability Accounting Standards Board (SASB), among others. While these standards and guidelines are voluntary, they are increasingly being used as a reference by regulators and financial institutions to guide their ESG risk management practices. Frameworks help ensure that data is consistent, standardised, and comparable across organisations and across industries.

III. Overview of ESG Regulation in the EU

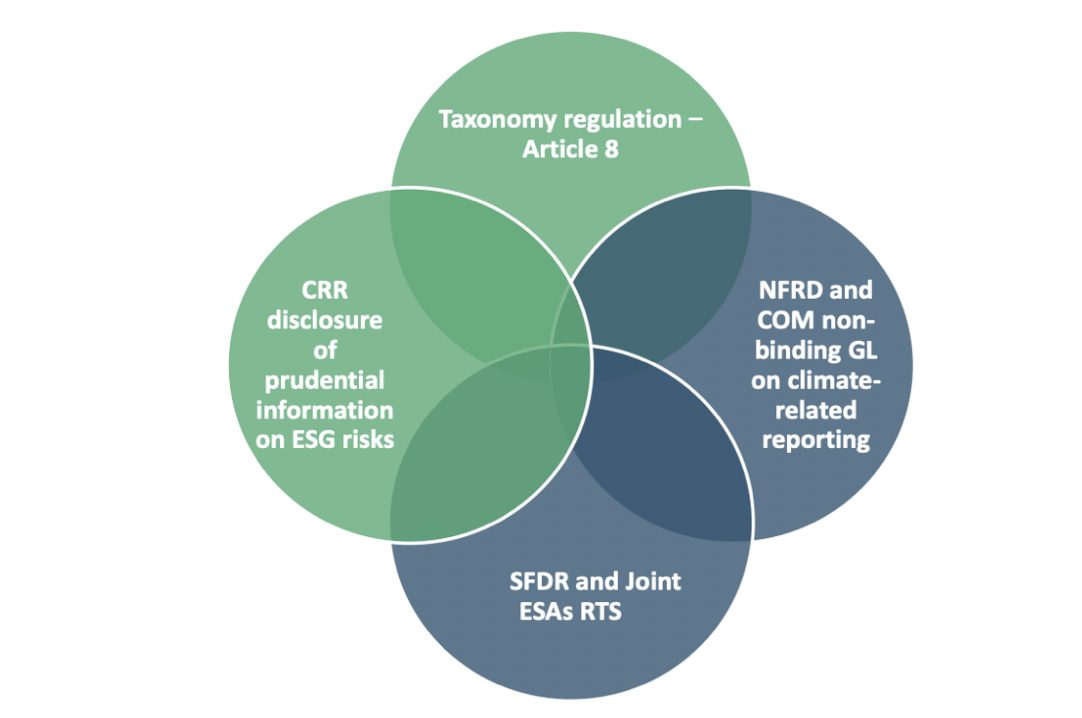

The EU’s ESG disclosure regulations are leading the way in global initiatives. With the introduction of the Green Deal, the EU Commission has set its intentions on improving transparency relating to sustainable finance, preventing greenwashing, and creating a resilient financial system. The Commission’s action plan on sustainable finance has triggered several legislative initiatives on ESG disclosures in the EU.

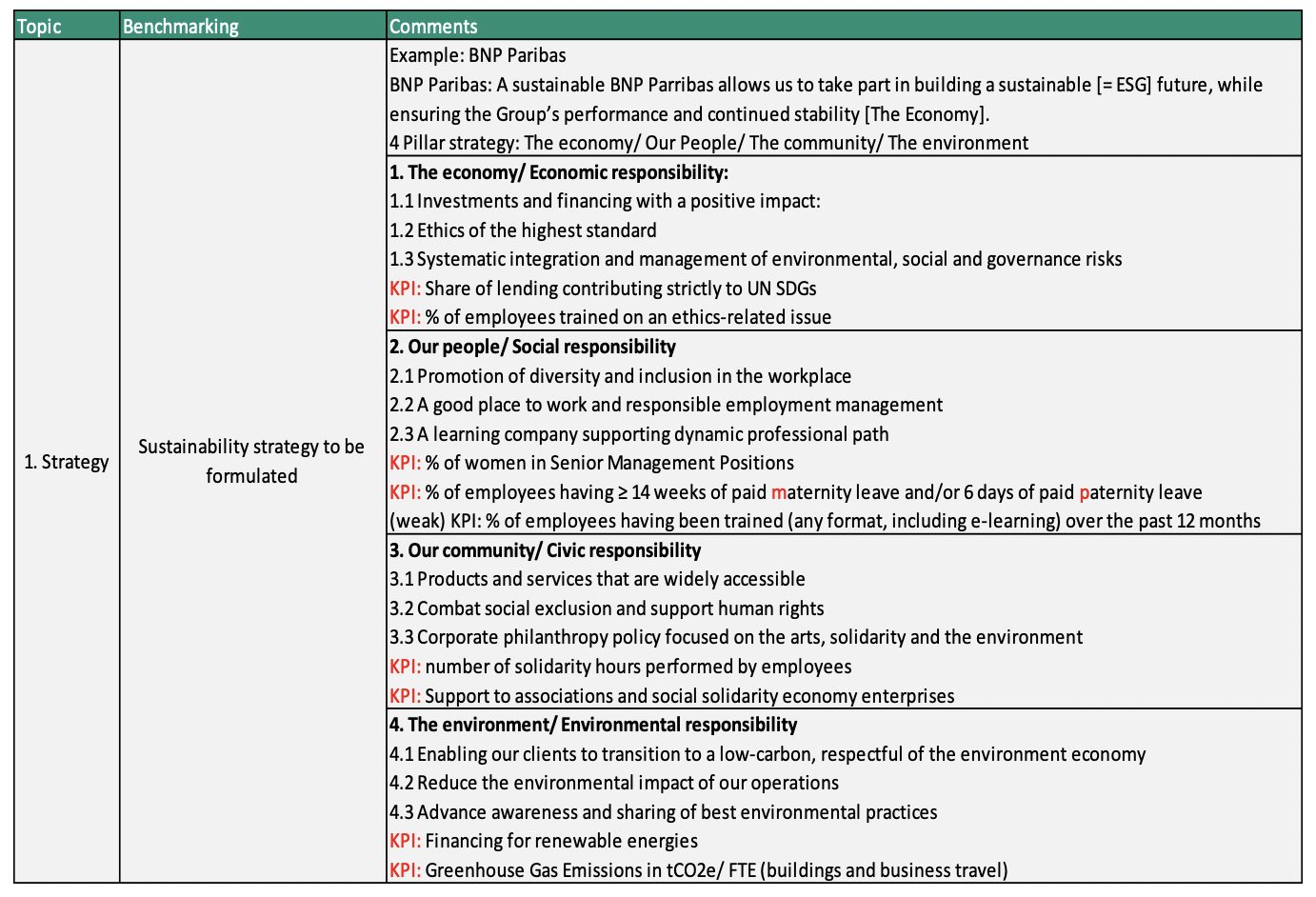

Figure 2: EU legislative initiatives on ESG-related disclosures

The EU Taxonomy Regulation: The EU has developed a comprehensive classification system which defines the criteria for identifying environmentally sustainable economic activities. This framework provides a standardised definition of what constitutes a sustainable investment, facilitating transparency and consistency in ESG reporting. Under Article 8 of the Taxonomy Regulation, large undertakings that are required to publish non-financial information pursuant to the Non-Financial Reporting Directive (NFRD)(‘relevant undertakings’) shall disclose information to the public on how and to what extent their activities are associated with environmentally sustainable economic activities.3 Other companies (e.g. SMEs, non-EU companies) may decide to disclose this information on a voluntary basis for the purpose of getting access to sustainable financing or for other business-related reasons.

Sustainable Finance Disclosure Regulation (SFDR): The SFDR lays down sustainability disclosure obligations for manufacturers of financial products and financial advisers towards end-investors. t imposes comprehensive ESG disclosure requirements covering a broad range of metrics at both entity- and product-level. It also mandates disclosure of adverse sustainability impacts, such as climate risks, and aims to enhance transparency and accountability. A Delegated Regulation, containing Regulatory Technical Standards (RTS) setting out the content, methodology and presentation of the sustainability information to be disclosed under the SFDR and these RTS will apply from January 1, 2023.

Non-Financial Reporting Directive (NFRD): The NFRD lays down the rules on disclosure of non-financial and diversity information by large companies, including environmental, social and governance information[4]. A new proposal adopted in 2021, the Corporate Sustainability Reporting Directive (CSRD), will amend the existing reporting requirements of the NFRD, extending the scope to all large companies and all companies listed on regulated markets (except listed micro-enterprises). Specifically, CSRD applies to organizations with over EUR 20 million in total assets, a net turnover of EUR 40 million and/or 250+ employees. These entities are referred to as ‘large undertakings’ within the CSRD and includes both EU companies and EU subsidiaries of non-EU companies.

Capital Requirements Regulation (CRR): Includes Article 449a on disclosure of environmental, social and governance risks. This Article requires large institutions which have issued securities that are admitted to trading on a regulated market of any Member State to disclose information on ESG risks, including physical risks and transition risks[5].

While the European Union has been at the forefront of adopting a proactive approach to ESG regulation, these laws are not being developed in isolation. The UK’s Financial Conduct Authority (FCA) has plans for a sustainable investment labelling system – with three categories: ‘Sustainable Focus’, ‘Sustainable Improvers’ and ‘Sustainable Impact’ – as well as rules to protect consumers from greenwashing (including naming and marketing rules for financial products), and additional product and entity level disclosures aimed at consumers and professional investors.[6] Furthermore, the FCA mandates climate-related disclosures for FCA regulated asset managers, life insurers and FCA-regulated pension providers, listed issuers and large UK private companies aligned with the recommendations of the Task Force on Climate-Related Financial Disclosures (TCFD) as part of its ESG strategy[7].

[4] European Commission. Non-Financial Reporting Guidelines. https://ec.europa.eu/info/publications/non-financial-reporting-guidelines_en

[5] European Banking Authority. Implementing Technical Standards (ITS) on prudential disclosures on ESG risks in accordance with Article 449a CRR. https://www.eba.europa.eu/implementing-technical-standards-its-prudential-disclosures-esg-risks-accordance-article-449a-crr

[6] Financial Conduct Authority. https://www.fca.org.uk/news/press-releases/fca-proposes-new-rules-tackle-greenwashing

[7] FCA. Enhancing climate-related disclosures by standard listed companies. https://www.fca.org.uk/publication/policy/ps21-23.pdf

Likewise, the US Securities and Exchange Commission (SEC) released a TCFD-aligned proposal on 21 March 2022 that requires publicly listed companies to disclose their risks related to climate change and their greenhouse gas emissions, as well as related governance processes, metrics, targets, and goals[8]. Furthermore, the SEC also announced a proposal intended to promote consistent, comparable, and reliable information for investors relating to funds and advisers’ incorporation of ESG factors.[9]

IV. ESG Disclosure Challenges for Financial Institutions

Many financial institutions have already made significant efforts to begin incorporating ESG into existing frameworks. However, several challenges remain. One of the primary challenges for financial institutions in complying with ESG regulations is the availability and quality of data. Data on ESG factors, such as carbon emissions, labour practices, and diversity and inclusion may be difficult to obtain for many financial institutions. And even when this data is available, there is still a lack of standardisation on how to report them. There are numerous reporting standards and frameworks, however, there is no universal standard, and financial institutions may find it challenging to navigate the different requirements and align their reporting with multiple frameworks. Additionally, regulations around ESG are evolving rapidly, and financial institutions must keep up with changing requirements which can be complex as it involves multiple dimensions, targets, and timeframes. This is further evidenced by both the PRA’s 2021 climate change adaptation report[10] and the ECB’s assessment on the transparency of banks’ disclosures which show that many banks face significant challenges due to the aforementioned factors.

V. Role of Financial Institutions in Advancing ESG Goals

Beyond mere compliance with ESG regulations, financial institutions can actively engage in a broader approach to address important economic, environmental, and societal developments. Banks play a crucial role in the allocation of financial resources for the smooth functioning of the economy. In doing so, they have the power to direct private investments towards supporting the transition to a sustainable and equitable economy that is both climate-resilient, and resource efficient. Financial firms can actively promote high ESG standards to their clients through many strategies. For instance, they can lend and engage solely with clients and issuers who prioritise sustainable activities and are ESG-friendly.

Through the promotion of sustainable investments, engaging with various stakeholders, including regulators, investors, customers, employees, and local communities as well as by driving innovation, financial institutions can support the development of sustainable solutions and contribute to the advancement of the ESG agenda, creating lasting impact across the entire economy.

[8]Securities and Exchange Commission. https://www.sec.gov/files/33-11042-fact-sheet.pdf

[9] Securities and Exchange Commission. https://www.sec.gov/news/press-release/2022-92

[10] Prudential Regulatory Authority https://www.bankofengland.co.uk/-/media/boe/files/prudential-regulation/publication/2021/october/climate-change-adaptation-report-2021.pdf?la=en&hash=FF4A0C618471462E10BC704D4AA58727EC8F8720

VI. Conclusion

ESG regulation is a critical development that reflects the growing significance of ESG considerations in the global financial landscape. While compliance with ESG regulations may pose challenges, financial institutions have an opportunity to go beyond compliance and actively contribute to the achievement of the sustainability objectives. Best practices and case studies of financial institutions that have successfully integrated ESG considerations into their business strategies demonstrate the potential for meaningful impact.

Looking ahead, the future of ESG regulation is likely to evolve, with increasing focus on standardisation, transparency, and accountability. Financial institutions need to stay updated with the changing regulatory landscape and continue to embrace ESG as a strategic imperative for long-term success.

As a leading consulting company in the field of financial services, we at Aspect Advisory are equipped to support banks and financial institutions in meeting their ESG reporting requirements. Our team of experts has in-depth knowledge of the evolving regulatory landscape and can provide tailored solutions to ensure compliance with ESG regulations for your jurisdiction.

Whether you need assistance with data collection and reporting, taxonomy alignment, or strategic ESG integration into your business practices, our consulting services can help you navigate the complexities of ESG regulation and unlock the potential benefits of sustainable finance.

Contact us at climate@www.aspectadvisory.eu or info@www.aspectadvisory.eu today to learn more about how our expertise can support your financial institution’s ESG reporting needs and contribute to your organization’s long-term sustainability success.

Contact us

Contact us

Partner,

Aspect Advisory

![]()

Prof. Dr Christian Schmaltz