Forecasting what exposure to a client might be at the moment they default

In the dynamic world of banking, understanding and managing risk is the linchpin of sustainable success. A shining beacon in this endeavor is the concept of Exposure at Default (EAD), an integral element of robust credit risk management. This article delves into the complex, yet fascinating realm of EAD, unraveling its intricacies, its significance in the banking landscape, and the methodology behind building effective EAD models. EAD is not just a theoretical construct, but a practical tool that empowers banks to gauge potential losses, strategise financial reserves, and optimize their decision-making process in a credit event. Embracing EAD not only enhances a bank’s resilience but also paves the way for its brighter and more secure future. Let’s embark on this enlightening journey to unlock the full potential of EAD and usher in a new era of banking excellence.

1.What is EAD

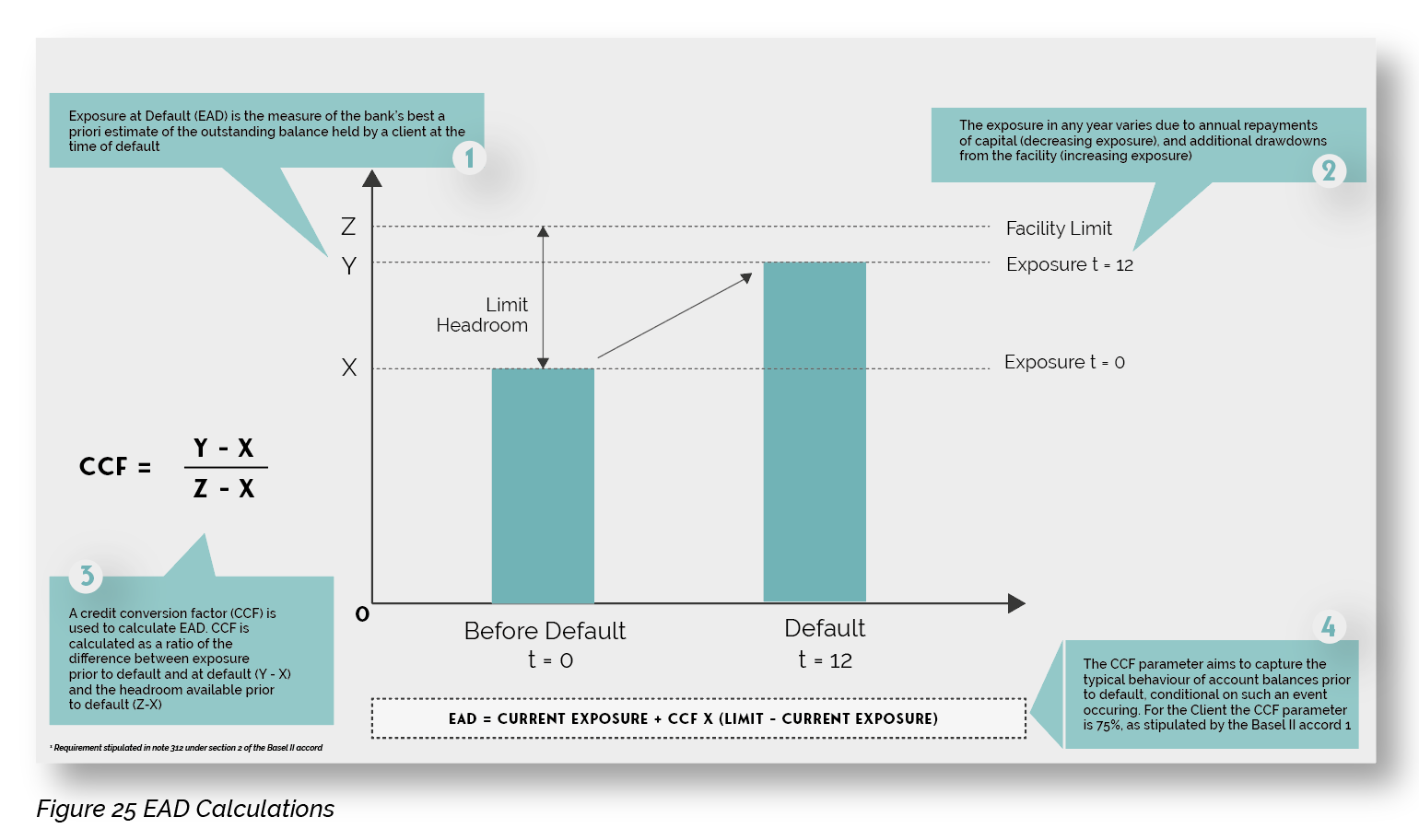

Exposure at Default (EAD) is the measure of the bank’s best upfront or prior estimate of the exposure or outstanding balance held by a client at the time of its theoretical default. In other words, the bank’s best estimate of how much a client likely to owe it in the event that it defaults. There are different approaches prescribed by the Basel Framework, that set out how conservative a bank should be in estimating EAD, based on how sophisticated its own modelling capability is.

While quite simple in theory, there are some specific issues that affect the overall estimate of EAD, namely:

- the definition of default, and components of

- EAD developmental approach and model structure employed by the bank

- Intended target or Ideal state for the Bank

2.Definition and the Components of EAD

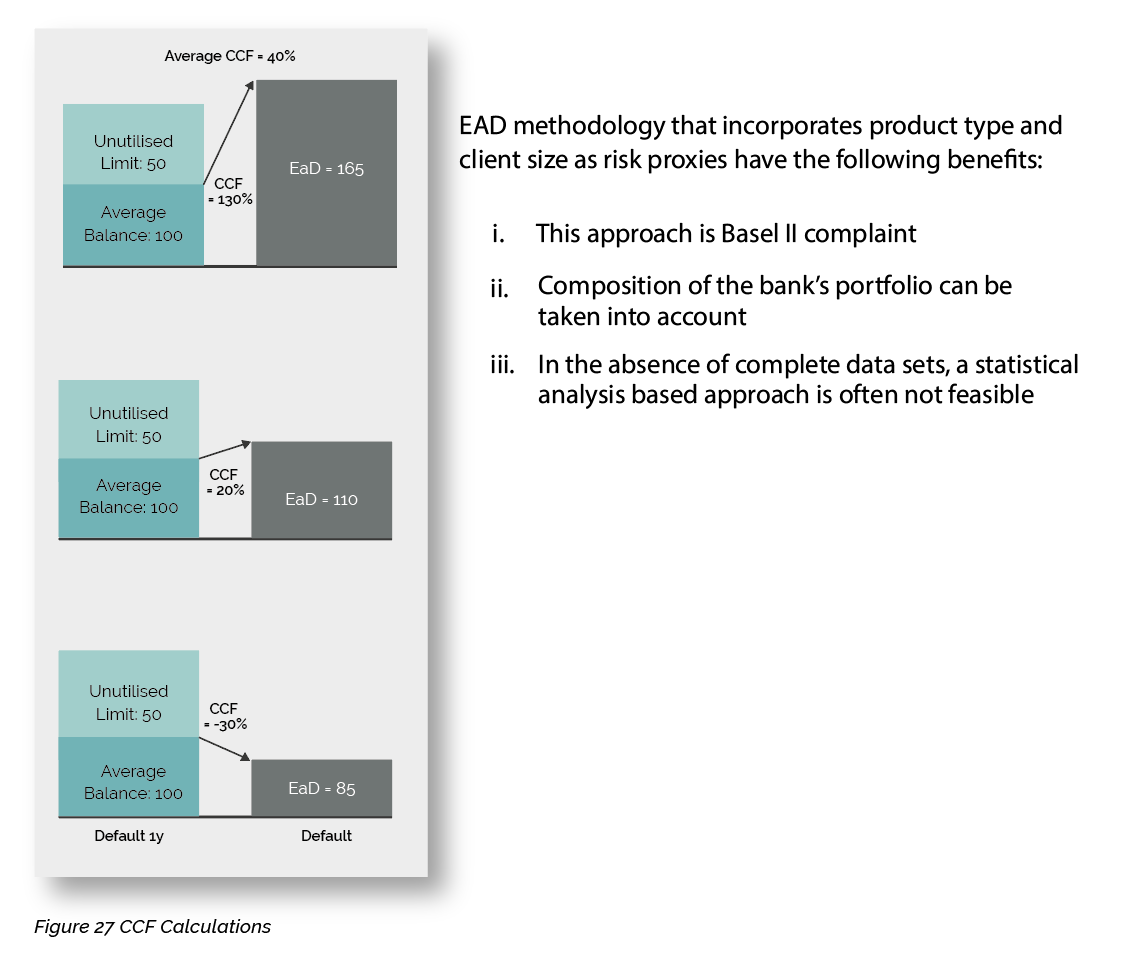

EAD is a calculated estimate measuring the total amount that a facility is likely to have been drawn down at the time of the obligor’s default. Whereas exposure is the current utilisation of a granted limit on a product, EAD measures the probable utilisation of the unutilised portion at the time of default (namely the exposure plus a portion of the unutilised facility, referred to as the Credit Conversion Factor (CCF)).

The generic function for calculating EAD is as follows –

EAD = Exposure + CCF x (unutilised limit)

Apart from current utilisation, other components of the EAD model will include –

- type of product

- size of client

- maturity

- other product specific information

- netting applied

- interest in suspense

3. Developmental Approach and Model Structure

Various methodologies and techniques are considered for the purpose of building the EAD Model. Before deciding on a methodology, it is essential to gather all available loss data with an appropriate degree of quality and accuracy which could in turn be used to support the use of traditional statistical techniques for model building purposes. With sufficient data which has an appropriate level of completeness and accuracy, statistical modelling can only be used to calculate EAD.

For first generation EAD models, there is often an incompleteness and data quality issue that only allows for a limited application of data available.In these circumstances, it is recommended that the Bank adopt a structural based EAD framework. Starting with the assumption that a defined product list with different CCFs would be applicable, the EAD methodology can be based on the following –

- mapping of all the products available in the portfolios

- validating specific parameters

- proposed according to different thresholds of specific variables (e.g.: for overdrafts different CCFs are proposed according to the turnover of the client)

- adjusting CCFs according to specific credit policies applied within the Bank

A robust and flexible structure of the model will allow for it to be used by individual users as well as for it to be used on a modelling platform for batch calculation purposes. The EAD model should have standalone functionality as well as integration with the PD and LGD Model.

4. Ideal state for the Bank’s EAD Model

The approach used in the EAD Model should be robust so that it can be upgraded and validated as and when additional expert judgement is made available. The benefit of this is that a batch calculation on the existing portfolio can be done with relative ease.

The main weakness of first-generation EAD model, is that it is unlikely to be portfolio specific at an industry level and therefore may have less granularity for the Bank’s portfolios overall.

5. EAD Principles and Development

5.1. EAD Components

5.1.1. Committed, Uncommitted and Risk of Further Drawdown

For most merchant, corporate and project finance banks, portfolios can be distinguished between a limit being committed or uncommitted. This classification was affects the application of the Credit Conversion factors (CCFs) and calculating a facility’s EAD. Senior business stakeholders need to be engaged and sign off on the classification of each product having a potential risk of being further drawn down past the current exposure at any given point. The key driver of classification for the EAD Model is if there is a risk of further drawdown or not.

CCF’s are typically only applicable to a limited number of facilities, such as on-balance sheet revolving facilities.

The reason for this is:

- Off-balance sheet items typically already have pre-determined CCFs applicable to those products.

- On-Balance sheet products are mostly term loans, which have an amortising limit. The ingoing assumption is that:

- term loans are drawn down in full (limit = exposure)

- after being drawn down the limit of the facility amortises with the exposure so there is no available headroom to which a CCF could be applied

5.1.2. FIRB CCF and Risk of Drawdown

The bank has the right to exercise discretion and cancel the credit line where a facility is uncommitted and therefore has no further risk of drawdown. However, in the case of a committed facility the bank cannot intervene by means of immediately cancelling the limit. Under the Foundation internal rating benchmark (FIRB) approach. A bank must make this distinction and account for it when calculating the applicable EAD. This means that under FIRB, if a limit is committed, a CCF of 75% will be used in the calculation of EAD; and a 100% CCF will be used when the limit is uncommitted.

5.1.3. AIRB CCF and Risk of Drawdown

The Advanced Internal ratings benchmark (AIRB) approach under Basel allows banks to use the same approach but based on their own estimates of CCFs. This distinction is only applicable where there is a clear differentiation between committed and uncommitted facilities.

CCFs will only be applicable when the facility is committed (i.e. where there is a risk of further drawdown), remembering that –

𝐸𝐴𝐷 = 𝐸𝑥𝑝𝑜𝑠𝑢𝑟𝑒 + 𝐶𝐶𝐹 × (𝑢𝑛𝑢𝑡𝑖𝑙𝑖𝑠𝑒𝑑 𝑙𝑖𝑚𝑖𝑡).

Exposure at default measures the total utilisation that may occur on any facility at the moment of a client’s default. Hence, the total amount that the Bank is exposed to. For the EAD, over and above the exposure, the current unutilised amount is added. This is to make a provision for the anticipated use of available headroom (unutilised portion) of the facility limit at the point of default.

5.1.4. EAD and Risk Tendency (RT)

EAD is a component of the RT calculation:

𝑅𝑇 = 𝑃𝐼𝑇𝑃𝐷 × 𝐿𝐺𝐷 × 𝐸𝐴𝐷

This is referred to as the expected loss over a one-year time horizon based on the PIT PD.

5.2. EAD Model Methodology

5.2.1. Model Structure and Conceptual Framework

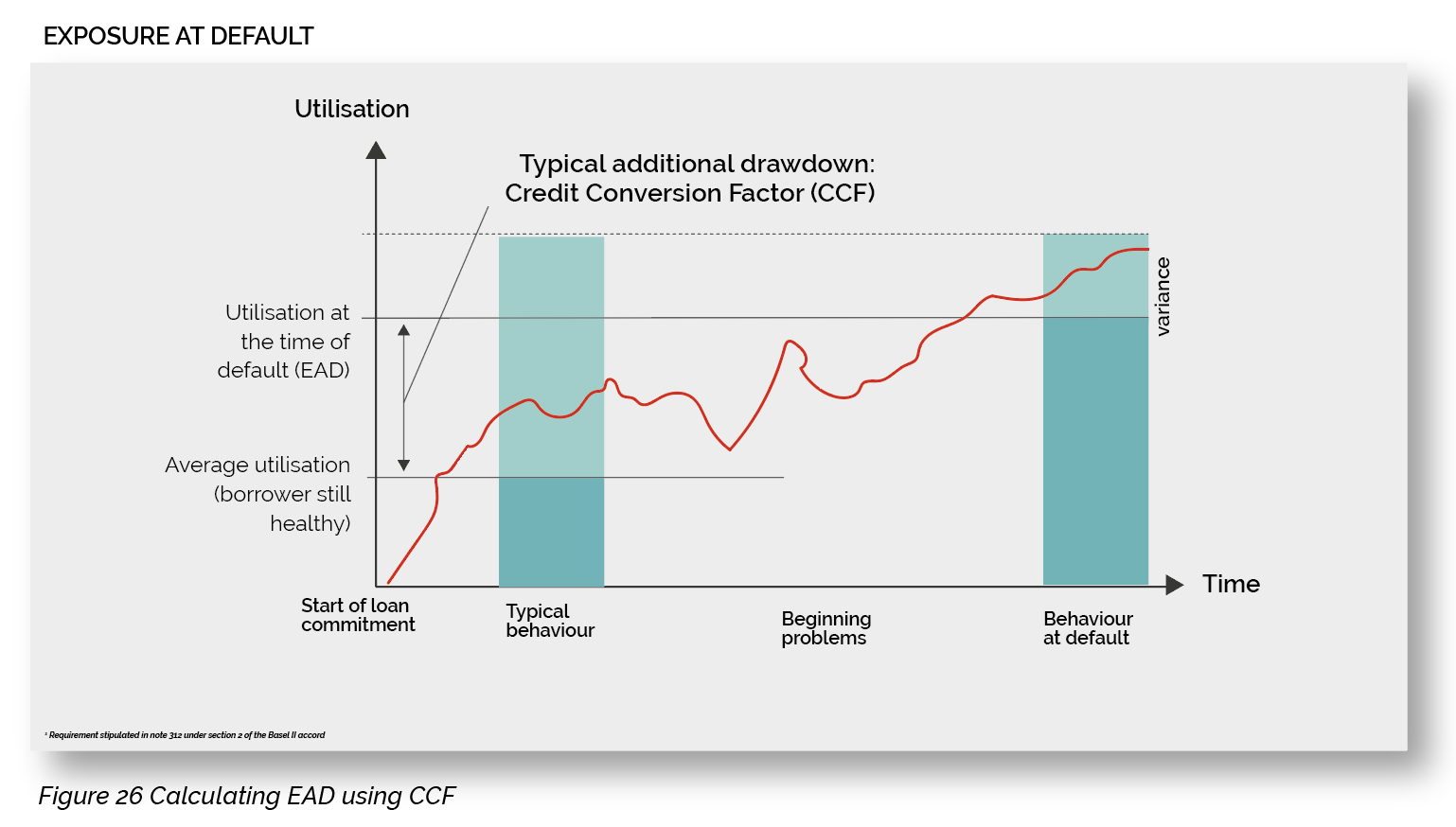

As we have established above, EAD is the measure of the bank’s best prior estimate of the outstanding balance held by a client at the time of default. EAD is a function of both current exposure as well as an estimate of potential utilisation of the available headroom (unutilised portion of a limit) in the event of default. A CCF is used to calculate this potential utilisation of the available headroom. The CCF parameter aims to capture the typical behaviour of account balances prior to their default. Under traditional modelling, this is calculated on the basis of past data which demonstrates the likely increase in exposure over time as an account nears default. There are several ways in which the CCF can be estimated. The most common method is calculated by looking at the exposure one year prior to default and then calculate the estimated CCF by use of statistical techniques.

The CCF is then applied ex-ante to new and existing facilities.

5.2.2. Moving to Default

As a client approaches default, they usually call on any unutilised lines of credit they have available to them. This implies that all the client’s borrowing lines will become increasingly utilised.

However, lenders seek to identify early signs of distress in order to be better equipped to manage any potential losses. Managing credit risk is done by maintaining an early warning list (EWL).

5.2.3. Practically addressing Credit Risk Mitigation

An Early Warning List (EWL) and Impairment committee should convene on a quarterly basis to address concerns and list recommendations. The committee should focus on clients on the EWL and potential financially distressed clients.

Each client is managed and monitored individually by a credit analyst within Credit Assurance. This management oversight aims to reduce a client’s limit. Furthermore, the credit analyst can edit the covenants of the loan agreement. This intensive monitoring and management done by the Credit Assurance team means that headroom utilisation can be kept to a minimum in the event of a client defaulting.

5.2.4. EAD for Revolving Credit

EAD for revolving credit lines is driven by:

Current exposure, available headroom, the difference between limit and current exposure. The headroom utilisation to the extent to which the available headroom is drawn at default.

A range of drivers of headroom utilisation may be postulated but only size is used as a key input field in the EAD Model. At a broad level, larger customers get more management attention (both sales and credit). Furthermore, cases having higher public disclosure obligations and requires signs of distress to be identified earlier with smaller clients. Hence, the current methodology expects headroom utilisation at default to fall with a rise in client size.

5.2.5. EAD for Loans

EAD for loans is calculated using the same approach determined for overdrafts. It still applies to the case even if the majority of them are fully drawn (the main exception being property development).

EAD for off-balance sheet products (i.e. letters of credit, traded products, financial and performance guarantees) is calculated using other assumptions. This is specific to the underlying contract which considers that facilities cannot be used to increase liquidity when a client is facing financial difficulties.

5.3. The approach to developing an EAD model

5.3.1. Product List

A first step in developing the EAD Model is to get a complete list of products available across the Bank’s portfolio. This list includes all products available that are both on and off-balance sheet products. Product experts need to be engaged with to compile the exhaustive product lists for the Bank.

5.3.2. Product Mapping

An exhaustive list of all products can then be mapped into the product groupings as defined by the Bank. Product mapping needs to be exhaustive therefore it has to add new categories or products as new information comes to light. Traded products should be expanded to include Spot and Forward Exchange transactions, but to also include all products classified as traded products. This can be done by making use of the current exposure method (CEM) as defined by Basel. It is suggested that CEM should be used for the Bank. When the portfolio is moved from FIRB to AIRB, Basel stipulates that the same approach may be followed for traded products.

Additional product groupings to be included in the model may include Factoring and Invoice Discounting, as well as Equity.

5.3.3. Validations

The model owner should involve validating specific parameters and adjusting the CCFs where appropriate justification is possible as the data environment get more comprehensive.

5.4. Business Engagement

Expert inputs form a key element of the EAD model build process where there is insufficient data. Experts from across the Bank should be engaged for the purpose of EAD modelling and can be done simultaneously with the LGD Model.

5.5. Model Data

The Bank’s portfolio losses for the past several years need to be taken into account. This bespoke loss database is used to maintain and capture loss and default data for EAD modelling purposes.

5.6. EAD Model Development

In order to calculate the EAD for revolving loans the user will need to input the Turnover in USD to the model. This is the proxy measure to determine the asset class risk weighting to be used.

The result of EAD model is the amount in the base currency that they borrowed.

6. Assessing your own Model’s strengths and weaknesses

Having built the model, it is important to identify and flag what are its strengths and weaknesses. For example, the workout structure is robust, logical and can be upgraded as default processes change or insolvency regime evolves. The structure of these type of model also makes it easier for experts to understand. Hence, making it more user-friendly.

The biggest challenge to this type of model is that it is usually based on logical assumptions and not on the results of statistical parameter estimation making it difficult to validate. Parameter estimation is largely reliant on expert inputs and external benchmarks. This might in turn indicate that the model may be overly conservative in predicting LGD. When there is insufficient data it is necessary to take a more cautious approach producing more conservative estimates of parameters.

The rationale behind the conservative estimates is the ease of updating the model as new information becomes available. The accuracy of the estimates relies on expert opinion legitimising the model because it is built on the foundation of industry practices.

Additional challenges in developing a model may be around the lack of a collateral management system reducing the collateral data available. A template of the Collateral data management for LGD should be provided and used going forward once the new model is deployed.

7. Model Monitoring and Validation

The performance of the models should be monitored on ideally a quarterly basis by the model stakeholders. The model should be updated and validated on an annual basis by the model owner. Furthermore, according to Basel requirement as new information comes to light it needs to be introduced into the model to validate the effectiveness of the model. Where is there a lack of historical data, assumptions are made on the probabilities and losses on the default event. As the data becomes more comprehensive these assumptions/parameters should be updated by the model owner.