1. Introduction

In this article, we will delve into the influence of model-based financial regulations on the shift towards achieving net-zero carbon emissions. We will also examine its advantages, constraints, and hurdles in shaping regulations. Additionally, we will identify key stakeholders capable of driving a sustained impact in this transition.

As the world grapples with the pressing need to address climate change, transitioning to net-zero carbon emissions has become a critical global goal. To achieve this ambitious target, countries are implementing various measures, including financial regulations. While these regulations often aim to promote sustainable practices, they may inadvertently hinder progress towards a carbon-neutral future.

The urgency of climate change has not always been commensurate with the pace of action by governments. However, mounting concerns surrounding climate-induced financial instability and stranded assets have prompted several academics and financial regulators to propose a range of potential policy changes to accelerate the green transition. While various policies aimed at assessing climate-related financial risks, such as climate stress testing and climate-related risk disclosure, have gained significant traction in recent years, financial policies directly fostering green investments have not received the same level of attention from policymakers, such as differentiated capital requirements. Yet, an often overlooked query in this field of study and among policymakers is whether existing financial regulations could potentially have adverse implications for achieving the net-zero carbon objective. 1

2. The Role of Financial Regulations in Addressing Climate Change

Financial regulations play a vital role in addressing climate change by providing incentives for sustainable practices, effectively managing climate-related risks, and fostering transparency and disclosure of environmental impacts.

By requiring financial institutions to disclose climate-related risks and opportunities, regulations can enhance market understanding and encourage the integration of environmental factors into investment decisions. Additionally, regulations can promote the allocation of capital towards low-carbon and renewable energy projects, fostering technological innovation and supporting the transition to a greener economy.

Model-based financial regulations also aim to enhance market transparency and disclosure surrounding climate-related risks and opportunities. By mandating financial institutions to disclose their exposure to climate risks, regulators foster transparency and enable market participants, investors, and stakeholders to make more informed decisions.

Moreover, model-based financial regulations promote the development of standardised methodologies for measuring and reporting climate-related risks. This standardisation allows for easier comparison and benchmarking, facilitating market participants’ ability to assess the sustainability and resilience of financial institutions.

3. Quantifying Climate-Linked Risks

One of the primary objectives of model-based financial regulations is to quantify the climate-related risks faced by financial institutions and markets. These risks encompass physical risks, such as damage caused by extreme weather events, as well as transition risks, including policy changes or shifts in investor sentiment.

By employing sophisticated mathematical models, regulators can simulate various scenarios and assess the potential impacts of climate change on financial institutions’ balance sheets and investment portfolios. This allows institutions to identify and quantify their exposure to climate-related risks, enabling informed decision-making and risk management strategies.

Furthermore, model-based financial regulations facilitate stress testing of banks and other financial institutions to evaluate their resilience against climate-related shocks. By subjecting institutions to extreme climate scenarios, regulators can assess their ability to withstand potential disruptions and make necessary adjustments to ensure financial stability.

4. The Benefits of Model-Based Financial Regulations

Financial regulations serve the purpose of upholding stability, safeguarding investor interests, and minimising risks within the financial system. Model-based regulations, which rely on predictive models and data analysis, have garnered significant attention owing to their potential benefits. These approaches have facilitated early risk detection, enhanced precision and impartiality, as well as optimised the allocation of regulatory resources. Consequently enabling authorities to operate with greater efficiency and insight.

Model-based financial regulations have made important contributions toward net-zero emissions in recent years. A key example is stress testing, where regulators require banks and other financial institutions to assess their resilience to different climate scenarios. The Network for Greening the Financial System pioneered climate stress testing, requiring banks to model the impacts of extreme weather and climate policies on their balance sheets. This revealed major climate risks and motivated banks to reduce their exposures. The EU and UK have since made stress testing mandatory, pressuring banks to align lending with climate goals. Another model-based tool is climate-related financial disclosures, whereby companies must disclose their greenhouse gas emissions and climate vulnerabilities based on common reporting standards. Disclosure requirements like the Task Force on Climate-Related Financial Disclosures (TCFD) make climate risks more transparent to investors and incentivise emissions reductions.

Dynamic climate risk models also allow insurers to better understand their climate exposures and charge risk-based premiums. This prices climate impacts like flooding into insurance markets, sending important price signals to property developers and homeowners. Overall, model-based regulations are steering finance toward net-zero alignment by quantifying climate risks and opportunities. Stress testing, disclosure rules, insurance pricing models and more are critical innovations driving the financial sector’s role in emissions reductions.

Other instances of model-based financial regulations that have facilitated advancements toward achieving net-zero emissions include:

1. Carbon Pricing Mechanisms:

The implementation of carbon pricing mechanisms in various jurisdictions, such as carbon taxes or cap-and-trade systems, involves the use of predictive models to evaluate the carbon footprint of companies and industries. By integrating the cost of carbon emissions into financial decision-making processes, these mechanisms create incentives for reducing emissions and promoting investments in cleaner technologies. Ultimately, they support the transition towards achieving net-zero emissions.

2. Green Bond Standards: Regulators and industry

The regulatory authorities and industry organisations have established benchmarks and certification requirements for green bonds, which fund environmentally sustainable initiatives. These criteria frequently integrate forecasting models to evaluate the ecological effects of projects financed by green bonds, guaranteeing that investments facilitate reductions in emissions and bolster the shift towards a net-zero economy.

3. Sustainable Investment Mandates:

In response to regulatory requirements, institutional investors are obligated to take into account environmental, social, and governance (ESG) factors such as climate risks when making investment decisions. The utilisation of predictive models is common practice for assessing the ESG performance of investment portfolios. This ensures that these investments align with long-term sustainability goals, including the shift towards a net-zero economy.

4. Scenario Analysis for Transition Risks:

Financial institutions are mandated by regulators to perform scenario analysis using predictive models to evaluate the potential impact of transitioning to a low-carbon economy on their portfolios. Through the examination of various transition pathways and related risks, institutions can gain a deeper understanding of how their investments might be influenced and adapt their strategies in order to facilitate the transition towards net-zero emissions.

5. The Limitations and Challenges of Model-Based Financial Regulations

While model-based financial regulations offer numerous advantages, it’s important to acknowledge their limitations and challenges. Understanding these limitations can help regulators and market participants navigate the potential risks effectively:

- Reliance on historical data:Models rely on historical data and assumptions about market behaviour. However, financial markets are dynamic and subject to constant change. Past data may not always accurately reflect future outcomes, especially during unprecedented events or market disruptions.

- Insufficient Data Collection and Reporting: Real-world examples abound, where companies faced public scrutiny due to inaccuracies or omissions in their sustainability reports. Whether it’s misrepresenting carbon emissions or failing to account for supply chain practices, insufficient data collection can result in a distorted narrative that erodes trust among stakeholders.

- Regulatory Lag and Adaptability: As environmental priorities rapidly evolve, regulatory frameworks may struggle to keep pace, leading to inefficiencies in achieving sustainability goals. Insightful analysis on specific cases where regulatory frameworks struggled to keep pace with changing environmental priorities can shed light on the challenges faced. For example, the time taken to update regulations to address new environmental risks and opportunities may create gaps in compliance, impacting the overall effectiveness of model-based financial regulations.

- Impact on Emerging Markets:

Emerging markets often encounter diverse obstacles, such as limited access to capital, technology, and infrastructure, which can impede their ability to comply with model-based financial regulations for sustainability. For instance, the lack of robust infrastructure in some emerging economies may pose challenges in accurately measuring and reporting carbon emissions, a key aspect of complying with model-based regulations for achieving net zero goals.

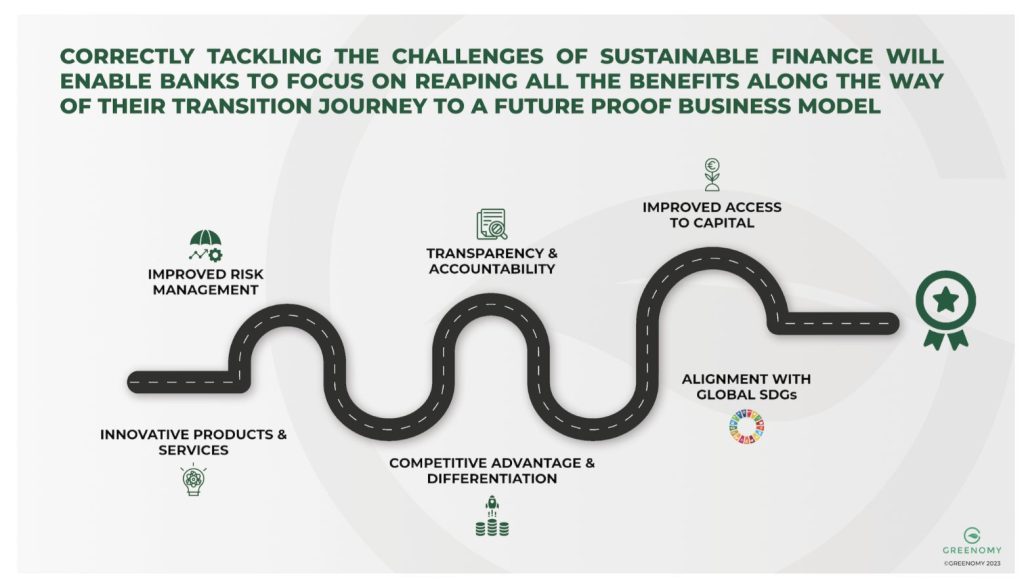

The adoption of sustainable finance reporting standards presents significant advantages for banks, despite the challenges involved.

Investments within the financial system play a crucial role in facilitating the green transition. However, there is an insufficient understanding of how existing financial regulations influence investment decisions. The Nature Climate Change 2024 article reveals that analysis of data from the European Banking Authority suggests that current financial accounting frameworks may inadvertently discourage investments in low-carbon assets.

The acceleration of the energy transition has the potential to yield global savings of £12tn and mitigate the severe impacts of global warming. Consequently, emphasis should be placed on eliminating obstacles that could impede this transition. 2

It is noted that banks are required to allocate nearly double the loan loss provisions for lending to low-carbon sectors compared to high-carbon sectors, as indicated by differences in provision coverage ratios. This bias is believed to stem from basing risk estimates on historical data and is further exemplified by consistently lower estimated historical financial risks for the oil and gas sector compared to renewable energy. These findings suggest that similar biases could exist in other model-based regulations like capital requirements, potentially impacting banks’ ability to finance green investments.

6. Crafting Effective Financial Regulations for Managing Climate-Related Risks

Policy makers encounter formidable challenges when designing regulations to address climate-risks. One of the primary hurdles is striking a delicate balance between risk management and the imperative to stimulate innovation and economic growth. Overly stringent regulations could stifle investment in sustainable technologies and impede economic progress, while inadequate regulations may leave the financial system vulnerable to climate-induced shocks.

Furthermore, there is a need to integrate climate considerations into existing regulatory frameworks without creating unnecessary compliance burdens. This involves navigating complex technical and scientific data to accurately assess and address climate-related risks within the financial sector.

6.1. Best Practices for Designing Effective Regulations

Designing effective financial regulations to manage climate-related risks requires adherence to key principles. Firstly, regulations should be forward-looking and adaptable to evolving climate dynamics. Flexibility is crucial to ensure that regulatory frameworks can effectively respond to new and unforeseen risks as our understanding of climate change advances.

Additionally, regulations should incentivise proactive risk management and sustainable investments while providing clear guidance to financial institutions. By incorporating risk assessment and disclosure requirements, regulators can promote transparency and accountability within the financial industry.

Several jurisdictions have successfully implemented balanced financial regulations that address climate-related risks without stifling innovation. For instance, the European Union’s sustainable finance taxonomy provides a comprehensive framework for classifying environmentally sustainable economic activities, fostering green investments while managing risks.

In the United States, the introduction of stress testing for climate-related financial risks has bolstered the resilience of the banking sector and improved risk management practices. These case studies exemplify how well-crafted regulations can simultaneously mitigate climate-related risks and contribute to economic development.

6.2. Future Outlook and Recommendations

The future of financial regulations in managing climate-related risks necessitates a proactive and collaborative approach. Policymakers should consider integrating climate scenarios into their risk assessments and stress tests to enhance the resilience of financial institutions. Moreover, fostering international cooperation and information-sharing mechanisms can facilitate a more comprehensive understanding and management of global climate-related risks.

Recommendations for future regulatory frameworks include the establishment of standardised reporting requirements for climate-related risks, promoting investment in sustainable projects, and creating financial incentives for climate resilience. By embracing these recommendations, policymakers can lay the groundwork for a more resilient and sustainable financial system.

7. Financial Institutions as Key Stakeholders

Financial institutions, including banks and investment firms, wield significant influence and impact on the economy and society at large. Their pivotal role in supporting sustainable initiatives and driving positive environmental change cannot be overstated. By integrating environmental considerations into their operations and investment decisions, these institutions have the power to catalyse a transition towards a greener and more sustainable economy.

7.1. Collaboration with Policymakers

Collaboration between financial institutions and policymakers is essential in the development and implementation of effective climate-based regulations. By working hand in hand, these stakeholders can align financial strategies with environmental objectives, ensuring that investments and lending practices are in line with sustainable principles. Successful partnerships between financial institutions and government entities serve as compelling examples of how collaborative efforts can address environmental challenges and drive positive change.

7.2. Challenges and Opportunities

Despite the clear benefits of aligning with climate-based regulations, financial institutions face various challenges in this pursuit. These may include navigating complex regulatory landscapes, assessing the long-term viability of green investments, and balancing financial returns with environmental impact. However, within these challenges lie opportunities for innovation, investment, and growth within the framework of sustainable finance, positioning financial institutions as key players in advancing environmental sustainability.

7.3. Best Practices and Case Studies

Leading financial institutions have embraced best practices in championing climate-friendly policies, setting examples for the industry at large. By integrating environmental risk assessments into their decision-making processes, offering green financial products, and disclosing climate-related information, these institutions are at the forefront of sustainable finance. Furthermore, case studies highlighting successful collaborations between financial institutions and policymakers underscore the tangible impact of proactive engagement in shaping impactful regulations.

By implementing a series of strategic initiatives such as, establishing regular forums for knowledge exchange, leveraging technological solutions to enhance regulatory compliance, and jointly formulating policy recommendations reflective of industry best practices it could further facilitate more effective collaboration. Furthermore, key decision-making processes can be characterised by a consultative approach, ensuring that the interests of all stakeholders are considered in the formulation and implementation of collaborative strategies.

7.4. Outcome and Impact

The successful collaboration can yield substantial positive outcomes, including enhanced operational efficiency for the financial institution, streamlined regulatory processes, and the implementation of innovative financial products and services. Moreover, the impact extended to policymaking initiatives, with the integration of industry insights leading to more informed and balanced regulatory decisions. Quantitatively, such collaborations can result in a notable increase in market stability and investor confidence, affirming the tangible impact of effective collaboration between financial institutions and policymakers.

8. Conclusion: Striking a Balance

While model-based financial regulations undoubtedly have the potential to contribute to the transition to net-zero carbon emissions, careful consideration must be given to their implementation to avoid unintentional setbacks. Striking a balance between regulation and innovation is crucial. It is essential to recognise the limitations of mathematical models and seek diverse sources of information when evaluating climate risks and opportunities.

To optimise the effectiveness of financial regulations in promoting sustainable practices, cooperation between regulators, financial institutions, and other stakeholders is paramount. Collaboration can help refine models, improve data quality, and develop more comprehensive frameworks that consider the interconnectedness of the financial system and climate change.

As the world strives towards a net-zero carbon future, it is imperative to evaluate the impact of financial regulations critically. While model-based regulations can play a role in driving sustainable finance, they must be carefully crafted to avoid unintended consequences that hinder the transition. By embracing innovation, staying vigilant about model limitations, and fostering collaboration, financial regulations can enable the finance industry to play a significant role in achieving the ambitious goal of net-zero carbon emissions.

Addressing these limitations and challenges requires ongoing scrutiny, refinement, and collaboration between regulatory authorities, financial institutions, and other stakeholders. It’s important for regulators to remain aware of the potential shortcomings of model-based regulations and to adopt a holistic approach to risk management and oversight.

By embracing transparency, mutual respect, and a shared commitment to positive outcomes, collaborative efforts can yield far-reaching benefits for both the financial industry and regulatory authorities. It is imperative for stakeholders across the financial services sector to explore and embrace collaborative opportunities, laying the groundwork for a resilient and prosperous future.

Sources:

- Model-based financial regulations impair the transition to net-zero carbon emissions: https://www.nature.com/articles/s41558-024-01972-w#data-availability

- Energy Transition: https://www.ox.ac.uk/news/2022-09-14-decarbonising-energy-system-2050-could-save-trillions-oxford-study

- Challenges and Opportunities for Banks on their path to net zero goals: https://www.greenomy.io/blog/sustainable-finance-banks-challenges-opportunities

Contact us

Stuart Thomson

Partner,

Aspect Advisory

![]()